Sarabjit Dhuna

Owner/Principal Broker

M09002095

CENTUM United Mortgages Inc.

Brokerage # 12696

Each office is independently owned and operated.

Direct

Mobile

Fax

(855) 336 1158

Address

6155 Tomken Road, Unit 3Mississauga ON L5T 1X3

More About Sarabjit Dhuna

I'm dedicated to guiding you through the mortgage process with ease and ensuring you’re fully informed about your options, whether you’re purchasing, renewing or refinancing. I take pride in my ability to communicate complex financial concepts in a way that’s easy for everyone to understand.

Purchasing a home can be a stressful experience, which is why I strive to make the process of securing a mortgage as seamless and stress-free as possible. Whether you’re a first-time homebuyer or a seasoned homeowner, I’m committed to finding the mortgage solution that best meets your unique needs.

If you need real estate financing in Mississauga or the surrounding area, I’d love to work with you!

Some of the best mortgage rates anywhere in Canada

Fixed 1 Year

4.84%

Fixed 3 Years

4.29%

Fixed 5 Years

4.39%

Please Note: Some conditions may apply. Rates may vary from Province to Province. Rates subject to change without notice. Posted rates may be high ratio and/or quick close which can differ from conventional rates. *O.A.C. & E.O

Unique, innovative and trusted mortgage services

I have access to a wide and varied range of Mortgage Services to suit your exact needs. I am here to help answer any questions you might have so please feel free to contact me for more information..

Renewing Your Mortgage

Buying Your First Home

Buying Your Next Home

Reverse Mortgages

Debt Consolidation

Vacation Property

New to Canada

Mortgages for Self-Employed

Commercial Mortgages

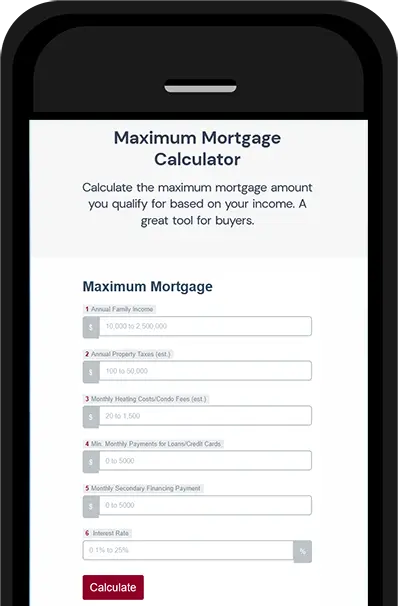

How Much Can You Afford?

Try one of my easy to use mortgage calculators to quickly and easily see what you can afford. Run payment scenarios, figure out land transfer costs, closing costs and much more!

Get Approved in 3 Easy Steps!

Find the Right Mortgage

I have access to over 50 lenders from across Canada to fit you into a mortgage solution

Tell Me Your Needs

Tell me about your financing needs so I can better understand your mortgage goals

Apply & Get Approved

Get pre-approved for your exact mortgage solution and start house shopping

Latest Blog Posts

Read More

Bank of Canada holds policy rate at 2.75%

Bank of Canada holds policy rate at 2.75%

The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%.

While some elements of US trade policy have started to become more concrete in recent weeks, trade negotiations are fluid, threats of new sectoral tariffs continue, and US trade actions remain unpredictable. Against this backdrop, the July Monetary Policy Report (MPR) does not present conventional base case projections for GDP growth and inflation in Canada and globally. Instead, it presents a current tariff scenario based on tariffs in place or agreed as of July 27, and two alternative scenarios-one with an escalation and another with a de-escalation of tariffs.

While US tariffs have created volatility in global trade, the global economy has been reasonably resilient. In the United States, the pace of growth moderated in the first half of 2025, but the labour market has remained solid. US CPI inflation ticked up in June with some evidence that tariffs are starting to be passed on to consumer prices. The euro area economy grew modestly in the first half of the year. In China, the decline in exports to the United States has been largely offset by an increase in exports to the rest of the world. Global oil prices are close to their levels in April despite some volatility. Global equity markets have risen, and corporate credit spreads have narrowed. Longer-term government bond yields have moved up. Canada's exchange rate has appreciated against a broadly weaker US dollar.

The current tariff scenario has global growth slowing modestly to around 2½% by the end of 2025 before returning to around 3% over 2026 and 2027.

In Canada, US tariffs are disrupting trade but overall, the economy is showing some resilience so far. After robust growth in the first quarter of 2025 due to a pull-forward in exports to get ahead of tariffs, GDP likely declined by about 1.5% in the second quarter. This contraction is mostly due to a sharp reversal in exports following the pull-forward, as well as lower US demand for Canadian goods due to tariffs. Growth in business and household spending is being restrained by uncertainty. Labour market conditions have weakened in sectors affected by trade, but employment has held up in other parts of the economy. The unemployment rate has moved up gradually since the beginning of the year to 6.9% in June and wage growth has continued to ease. A number of economic indicators suggest excess supply in the economy has increased since January.

In the current tariff scenario, after contracting in the second quarter, GDP growth picks up to about 1% in the second half of this year as exports stabilize and household spending increases gradually. In this scenario, economic slack persists in 2026 and diminishes as growth picks up to close to 2% in 2027. In the de-escalation scenario, economic growth rebounds faster, while in the escalation scenario, the economy contracts through the rest of this year.

CPI inflation was 1.9% in June, up slightly from the previous month. Excluding taxes, inflation rose to 2.5% in June, up from around 2% in the second half of last year. This largely reflects an increase in non-energy goods prices. High shelter price inflation remains the main contributor to overall inflation, but it continues to ease. Based on a range of indicators, underlying inflation is assessed to be around 2½%.

In the current tariff scenario, total inflation stays close to 2% over the scenario horizon as the upward and downward pressures on inflation roughly offset. There are risks around this inflation scenario. As the alternative scenarios illustrate, lower tariffs would reduce the direct upward pressure on inflation and higher tariffs would increase it. In addition, many businesses are reporting costs related to sourcing new suppliers and developing new markets. These costs could add upward pressure to consumer prices.

With still high uncertainty, the Canadian economy showing some resilience, and ongoing pressures on underlying inflation, Governing Council decided to hold the policy interest rate unchanged. We will continue to assess the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs related to tariffs and the reconfiguration of trade. If a weakening economy puts further downward pressure on inflation and the upward price pressures from the trade disruptions are contained, there may be a need for a reduction in the policy interest rate.

Governing Council is proceeding carefully, with particular attention to the risks and uncertainties facing the Canadian economy. These include: the extent to which higher US tariffs reduce demand for Canadian exports; how much this spills over into business investment, employment and household spending; how much and how quickly cost increases from tariffs and trade disruptions are passed on to consumer prices; and how inflation expectations evolve.

We are focused on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval. We will support economic growth while ensuring inflation remains well controlled.

Information note

The next scheduled date for announcing the overnight rate target is September 17, 2025.

Source: Bank of Canada Website

Mortgage Payments Ease, Renewal Stress Grows in Canada

Mortgage Payments Are Easing Yet Renewal Stress Is Real

It feels like a collective exhale. After two grueling years of rapid interest‑rate hikes, the Bank of Canada has paused and even trimmed its policy rate, and many homeowners are finally seeing monthly mortgage payments drift lower. At first glance this sounds like unqualified good news. In reality, the picture is more complicated. Roughly six in ten Canadian mortgages will renew in 2025 or 2026, and for many borrowers, the new payment will still be higher than what they locked in during pandemic lows. In this explainer we unpack why payments are easing overall, what renewal stress looks like on the ground, and how to structure a game plan before your own mortgage comes due.

Did You Know?

- The average variable‑rate borrower with adjustable payments has seen monthly costs fall by roughly five to seven percent since the start of 2025.

- About two million mortgages, representing sixty percent of outstanding loan balances, will renew in the next eighteen months.

- Nationally, total mortgage payments declined by one point seven percent in the final two quarters of last year, the first back‑to‑back drop since 2020.

- The household debt‑service ratio steadied at fourteen point four percent in Q1 2025, down from the record fifteen point one percent seen in late 2023.

- Five‑year fixed terms signed in 2020 at around two percent are rolling over into rates in the four percent range, doubling the interest portion even after recent cuts.

Why Some Payments Are Finally Coming Down

Mortgage payments respond to two mechanical levers: interest rates and amortization schedules. The Bank of Canada began modest rate cuts in early 2025, and lenders quickly passed those savings to variable‑rate clients whose contracts adjust in real time. Fixed‑rate shoppers also benefit because bond yields have retreated on softer inflation. Meanwhile, homeowners who hit their trigger rate in 2023 were already making lump‑sum prepayments or stretching amortizations, so even small rate relief translates into meaningful monthly savings.

At the macro level, Statistics Canada reported that mortgage interest payments declined by zero point three percent in Q1 2025, the third decrease in four quarters. Combine this with steady income growth and the result is a debt‑service ratio that has eased off its peak. That said, the improvement is uneven. Borrowers on adjustable variable contracts are cheering, while those locked into fixed terms from the low‑rate era are bracing for impact.

The Renewal Crunch: Why 2025‑2026 Will Test Budgets

Renewal stress is not a catchy headline, it is a math problem. Imagine a homeowner who borrowed five hundred thousand dollars at one point eight percent in 2020. Their monthly payment was roughly two thousand one hundred dollars. If that mortgage renews at four point four percent, the new payment jumps to about two thousand seven hundred, an increase of roughly six hundred dollars a month. For households without spare cash flow, that delta can crowd out everything from grocery budgets to retirement contributions.

Regulators are watching closely. The latest Bank of Canada Financial Stability Report notes that sixty percent of mortgages renewing by late 2026 will face higher payments even under a soft‑landing rate scenario. Stress‑testing rules require lenders to qualify borrowers at the greater of two percent above contract or five point two five percent, but renewal affordability still depends on income growth, inflation, and employment stability.

Five Ways to Cushion Your Renewal

- Start the conversation early. Six to eight months before maturity gives you time to compare options and lock a rate as protection.

- Boost your prepayment. Even an extra hundred dollars a month today reduces the principal you carry into a higher‑rate environment.

- Consider extending amortization cautiously. A longer schedule lowers the payment, then you can accelerate once rates normalize.

- Consolidate high‑interest debt. Rolling credit‑card balances into a refinanced mortgage can free cash flow for the renewal bump.

- Explore a blended rate. Some lenders allow you to combine your existing rate with current market rates, creating a mid‑point that softens sticker shock.

Top 10 Frequently Asked Questions

1. Why are national mortgage payments dropping if rates only dipped slightly?

Aggregate numbers blend variable loans, new originations, and fixed terms that have not yet

renewed. The mix, plus income growth, is dragging the average lower.

2. Will everyone renewing in 2025 see a payment hike?

No. Borrowers who chose variable loans in 2023 at peak rates may see lower payments. Fixed‑rate

borrowers from 2020‑2021 will likely pay more.

3. How big could my payment increase be?

Households rolling from two percent to four and a half percent could see monthly costs rise

twenty to twenty five percent, depending on amortization.

4. Does my stress‑test rate guarantee I can afford the renewal?

It helps, but the test assumes stable income and no additional debt. Life changes can erode

that buffer, so revisit your budget early.

5. Can I switch lenders at renewal with no penalty?

Yes, penalties disappear at maturity, though you may still pay appraisal and legal fees,

which many lenders will cover to earn your business.

6. What if rates fall further before my renewal date?

You can often sign a rate‑hold with a broker or lender that lets you float down if market

rates drop before closing.

7. Is it worth breaking early to lock a lower five‑year fixed now?

Run the math on penalties versus savings. In many cases, waiting until ninety days out avoids

unnecessary costs.

8. How does an extended amortization affect long‑term interest?

It lowers payments today but adds interest over the life of the loan. Treat it as a temporary

tool, not a permanent solution.

9. Should I choose variable or fixed this cycle?

Variable loans offer savings if rates keep drifting lower, but fixed provides certainty. A

hybrid mortgage can split the difference.

10. Could widespread renewal stress trigger a housing downturn?

Analysts see limited systemic risk because job markets remain healthy, but localized price

softness is possible if distressed sales rise in certain regions.

Key Canadian Mortgage Stats, Mid‑2025

- Bank of Canada policy rate: two point seventy five percent, unchanged since early June.

- Prime lending rate: four point ninety five percent at most major banks.

- Variable‑rate mortgages with adjustable payments: five to seven percent average payment drop year‑to‑date.

- Household debt‑service ratio: fourteen point four percent, down from the fifteen point one percent peak in Q4 2023.

- Mortgages up for renewal by end‑2026: approximately sixty percent of outstanding balances, or two million loans.

- Five‑year fixed rate today: around four point four percent for well‑qualified borrowers, versus pandemic lows near two percent.

- Mortgage delinquency rate: steady at zero point sixteen percent nationally, historically low but edging higher in oil‑producing provinces.

- Average mortgage size on new originations: four hundred fifty eight thousand dollars, up three percent from a year ago.

Your Next Steps

A gentle dip in payments should not lull anyone into complacency. If your renewal lands in the next two years, start planning today. Update your budget, gather documents, and speak with a mortgage professional who can model scenarios. Even a single proactive move such as a prepayment or a blended extension can soften the landing. Mortgage markets move quickly, but preparation lets you move faster.

Have more questions? Reach out and our team will walk you through a free renewal readiness checkup, complete with rate forecasts, amortization options, and cash‑flow strategies suited to your goals.

Double-Barrel Down Payments: FHSA + New $60k HBP Withdrawal Rules Explained

Scraping together a competitive down payment in 2025 often feels like a marathon. But two revamped federal programs-the First Home Savings Account (FHSA) and the beefed-up Home Buyers' Plan (HBP)-let first-time buyers tag-team their tax shelters, potentially unlocking six figures of cash without triggering a tax bill. Below, we break down the rules, the math, and the smart ways to combine them so you can hit the starting line of your home search with real momentum.

At-a-Glance: Key Limits & Timelines

- FHSA annual contribution room: $8,000; lifetime max: $40,000 (unused room carries forward).

- HBP withdrawal cap: $60,000 per buyer (up from $35,000).

- FHSA funds must be used within 15 years of opening the account; HBP withdrawals must be repaid to an RRSP over 15 years, starting the second calendar year after withdrawal.

- You can now use both programs for the same qualifying home purchase.

How the FHSA Works in 2025

Think of the FHSA as the love-child of an RRSP and a TFSA: contributions are tax-deductible now, and qualified withdrawals are tax-free later. You can deposit up to $8,000 per year until you hit the $40,000 lifetime ceiling, and any unused annual room rolls forward, so opening an account early maximizes flexibility (Source: CRA-First Home Savings Account, updated April 2025).

Contribution receipts lower your taxable income like an RRSP, and your growth compounds tax-free. You have a 15-year "participation period" to buy or build a qualifying first home. If you change your mind, you can roll the balance into an RRSP without affecting your RRSP contribution room, keeping the tax deferral intact.

The New $60k HBP: What Changed?

The 2024 federal budget boosted the RRSP withdrawal limit under the Home Buyers' Plan to $60,000, reflecting bigger down-payments in today's market (Source: Budget 2024, Chapter 1: More Affordable Homes). This change applies to withdrawals made on or after April 16, 2024 and extends to buyers with disabilities purchasing an accessible home.

You still need to repay the borrowed amount to your RRSP over 15 years or include any missed instalments in your taxable income. But the higher ceiling means a couple can now pull up to $120,000-and combine that with two FHSAs for a potential $200k+ down payment.

Double-Barrel Strategy: FHSA + HBP Together

Because Ottawa treats the FHSA and HBP as separate vehicles, you can tap both for the same purchase. A buyer who maxes their FHSA ($40k) and RRSP withdrawal ($60k) walks into their offer negotiations with $100,000-before even adding partner contributions or cash savings (Source: CRA-HBP Overview, updated January 2025).

That larger down payment can:

- Knock the home price below the 20 % mortgage-insurance threshold, saving thousands in CMHC premiums.

- Cut the mortgage balance, improving affordability stress-test ratios.

- Reduce long-term interest costs-especially valuable while BoC policy rates remain at 2.75 % (Source: Bank of Canada Rate Announcement, June 4 2025).

Timing Your Contributions & Withdrawals

- Open early: You unlock a fresh $8k FHSA room every January 1 after the account is opened, even if you contribute $0 the prior year.

- Front-load RRSPs: If cashflow is tight, contribute to your RRSP first, claim the tax refund, then re-invest the refund in the FHSA to double-dip on deductions.

- Coordinate closing date: FHSA withdrawals must occur before you take title; HBP withdrawals must be within 30 days of closing.

- Track repayment start: Missed HBP instalments are taxed, so set calendar reminders or automate contributions.

Why 2025 Buyers Are Leaning In

CMHC's 2025 Housing Market Outlook projects modest national price growth of 2–3 % through 2026, citing improved affordability as rates drift lower but inventory stays tight (Source: CMHC Housing Market Outlook, February 5 2025). Against that backdrop, first-timers with bigger liquid down payments will stand out to sellers and lenders alike.

Common Pitfalls to Avoid

- Overcontributing: FHSA overages incur a 1 % monthly penalty on the excess; use CRA MyAccount to check your room.

- Forgotten HBP instalments: Even $1 missed becomes taxable income for that year.

- Double-counting timelines: The 15-year FHSA clock and the 15-year HBP repayment schedule run independently-track them both.

- Market timing: Waiting for the "perfect" price can erase tax savings if rates rise again-balance patience with opportunity.

Top 5 Buyer Questions in 2025

1. Can I open an FHSA if I already own an investment property?

No. You must not have lived in a home you or your spouse owned in the current or previous four calendar years to qualify (Source: CRA FHSA eligibility).

2. Do FHSA contributions affect my RRSP room?

Good news-they don't. FHSA deposits sit on top of your RRSP and TFSA limits, giving you fresh tax-deductible space.

3. When do HBP repayments start under the new $60k limit?

The schedule hasn't changed: the second calendar year after the year you withdraw. If you take funds in 2025, repayments begin in 2027.

4. Can I combine an FHSA withdrawal, an HBP withdrawal, and a gift from parents?

Absolutely. Lenders will simply verify each source. A larger equity stake can even help you qualify under the mortgage stress test.

5. What happens if I don't buy within 15 years of opening my FHSA?

You must close the FHSA by the end of that year-rolling the balance into an RRSP or withdrawing it as taxable income. Rolling keeps the tax shelter intact.

Leveraging the FHSA and the enhanced HBP is one of the fastest ways to turn "someday" into "sold." If you're ready to map out a contribution strategy, or need help proving the down-payment source to a lender, our team is a click away.

Bank of Canada June Rate Hold: Mortgage Strategy 2025

Why the June Rate Hold Matters

On June 4 2025, the Bank of Canada (BoC) left its overnight rate unchanged at 2.75 % for the fourth meeting in a row (Source: Bank of Canada press release, June 4 2025). While the headline sounded uneventful, the ripple effects shape every mortgage conversation you'll have for the rest of the year, from first-time buyers wondering whether to go variable to renewal clients debating a three-year versus a five-year fix.

Variable-Rate Borrowers: Breathing Room but No Holiday

Because most Canadian variable-rate mortgages are priced "prime minus," a steady policy rate means prime (currently 4.95 %) stays put. Monthly payments on adjustable-payment variables remain the same, and static-payment variables avoid hitting a new trigger rate. Yet holding flat isn't the same as relief, amortizations are still stretched for thousands of borrowers who absorbed last year's hikes. If you're in that camp, use this pause to revisit a prepayment plan or consider converting to a shorter fixed term.

Fixed-Rate Outlook: Bond Yields Take Centre Stage

Five-year Government of Canada bond yields dipped below 3 % after the BoC announcement as traders priced in two potential cuts later this year. Lenders have already trimmed discounted five-year fixed rates by 10–15 bps since mid-May. The window could be brief: a stronger-than-expected GDP print or another bump in U.S. Treasury yields would push Canadian bonds higher, dragging fixed mortgage rates with them.

Stress-Test Implications

OSFI's mortgage stress test uses the greater of 5.25 % or the contract rate + 2 %. With deep-discounted five-year fixed deals now hovering around 4.54 %, many borrowers are still qualifying at 6.54 %, almost a full point lower than last autumn. That improved headroom can raise a household's maximum loan amount by roughly 7 %–8 %, making pre-approval timing a strategic lever for summer buyers.

Smart Moves for the Remainder of 2025

- Stagger terms: Blend a shorter three-year with a five-year to hedge both directions.

- Early renewal: Clients maturing in the next 12 months can lock today's fixed rates before fall volatility.

- Prepayment sweeps: Channel tax refunds and bonuses into principal while rates are stable.

- HELOC strategy: Combine a variable-rate HELOC for flexibility with a fixed-rate mortgage for certainty.

- Rate-float option: Some lenders now allow a one-time switch from fixed to variable without penalty, perfect if cuts arrive in Q4.

For brokers and agents, the advisory edge lies in scenario modelling: show clients how a single 25-bp BoC cut could shave $13–$15 off every $100,000 of variable balance, and contrast that with the cost of waiting if fixed rates bounce first. Tools like mortgage rate "trigger-point" alerts and automated renewal reminders keep you front-of-mind when the next policy move lands.

Bottom Line

A rate hold may sound like a non-event, but it's a strategic pause that savvy Canadians can leverage. Whether that means stress-test relief for new buyers or a stress-free renewal for existing homeowners, guidance from an informed mortgage professional makes all the difference.

Frequently Asked Questions

Q1. Does the June rate hold change the qualifying rate right away?

A1. Only indirectly. If your contract rate plus 2 % falls below 5.25 %, the stress-test floor stays 5.25 %. When discounted fixed rates drop enough, you'll qualify slightly easier.

Q2. Should I lock a fixed rate now or wait for possible cuts?

A2. If your closing is within 90 days, today's fixed rates look attractive versus early-2024 highs. You can also choose a lender that lets you "float down" if rates improve before funding.

Q3. Are HELOC rates frozen too?

A3. Yes. Most HELOCs are priced at prime plus a spread. With prime steady, your HELOC rate remains unchanged until the BoC moves again.

Q4. Could the Bank of Canada still cut rates later in 2025?

A4. According to BoC Governor Tiff Macklem, the Governing Council is "prepared to act" if unemployment softens and inflation trends toward 2 % (Macklem press conference, June 4 2025). Markets currently price a 60 % chance of a 25-bp cut by December.

Q5. How can a mortgage broker help me navigate this?

A5. Brokers compare dozens of lender promos daily, model rate scenarios, and negotiate rate-hold extensions, giving you clarity and potentially saving thousands over the life of your mortgage.

Why the Bank of Canada’s Rate Pause Isn’t a Green Light for Cheap Mortgages

If you've been waiting for interest rates to drop before locking in a mortgage, you're not alone. On June 5, 2025, the Bank of Canada (BoC) decided to hold its overnight lending rate at 4.75%, marking the first pause in rate hikes in over two years. While many Canadians hoped this would mean significantly lower mortgage rates, the reality is a bit more complex.

What Does a Rate Pause Mean?

A "rate pause" means the Bank of Canada didn't increase or decrease its key interest rate this time around. It's a signal that inflation is starting to cool off just a bit, but not enough for them to start slashing rates just yet. That's important because this overnight rate influences how much lenders charge for variable-rate mortgages, lines of credit, and other loans.

So, Are Mortgage Rates Going Down?

Not necessarily. While a pause may lead to slightly lower fixed mortgage rates, especially if the bond market reacts positively, there's no guarantee we'll see a big drop right away. In fact, some lenders are still playing it cautiously because of ongoing concerns like:

- Sticky inflation, especially in food and housing

- Tariffs affecting supply chains and prices

- Global uncertainty that could impact our economy

Fixed vs. Variable: What Should You Do?

If you're in the market for a mortgage, now might be the time to compare fixed and variable options more closely.

Fixed-rate mortgages are typically tied to bond yields, which have started to ease. This could mean better deals are on the horizon, especially for shorter terms like 1–3 years.

Variable-rate mortgages are directly linked to the BoC's rate. Since there's no cut yet, your payments won't drop-though some economists are predicting a cut later in 2025.

???? Tip: If you're renewing your mortgage or looking to buy soon, consider a shorter fixed term. This lets you ride out today's rates while staying flexible for future drops.

Why This Isn't a "Go" Signal...Yet

Although this pause is encouraging, the Bank has made it clear that it is still watching the economy closely. If inflation flares up again, they could hold or even hike rates again. On the flip side, if things cool down faster than expected, a rate cut could come later this year.

What You Can Do Now

If you're unsure about what to do with your mortgage in this environment, here are a few simple steps:

- Review your current rate – Know what you're paying now and what your options are.

- Speak to a mortgage broker – We can shop the market for the best rates and advise you on timing.

- Consider pre-approval – If you're planning to buy, locking in a rate now could protect you from potential increases.

Final Thoughts

The Bank of Canada may have paused its interest rate hikes, but that doesn't mean we should celebrate just yet. Mortgage rates are not falling significantly, and the economic outlook remains mixed. However, this is a great time to start planning and positioning yourself for what comes next.

If you're interested in exploring your mortgage options or need assistance understanding how this situation affects your budget, let's discuss it. We are here to help you make confident and informed decisions about your home financing.

June 4-2025 - Bank of Canada holds policy rate at 2.75%

The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%.

Since the April Monetary Policy Report, the US administration has continued to increase and decrease various tariffs. China and the United States have stepped back from extremely high tariffs and bilateral trade negotiations have begun with a number of countries. However, the outcomes of these negotiations are highly uncertain, tariff rates are well above their levels at the beginning of 2025, and new trade actions are still being threatened. Uncertainty remains high.

While the global economy has shown resilience in recent months, this partly reflects a temporary surge in activity to get ahead of tariffs. In the United States, domestic demand remained relatively strong but higher imports pulled down first-quarter GDP. US inflation has ticked down but remains above 2%, with the price effects of tariffs still to come. In Europe, economic growth has been supported by exports, while defence spending is set to increase. China's economy has slowed as the effects of past fiscal support fade. More recently, high tariffs have begun to curtail Chinese exports to the US. Since the financial market turmoil in April, risk assets have largely recovered and volatility has diminished, although markets remain sensitive to US policy announcements. Oil prices have fluctuated but remain close to their levels at the time of the April MPR.

In Canada, economic growth in the first quarter came in at 2.2%, slightly stronger than the Bank had forecast, while the composition of GDP growth was largely as expected. The pull-forward of exports to the United States and inventory accumulation boosted activity, with final domestic demand roughly flat. Strong spending on machinery and equipment held up growth in business investment by more than expected. Consumption slowed from its very strong fourth-quarter pace, but continued to grow despite a large drop in consumer confidence. Housing activity was down, driven by a sharp contraction in resales. Government spending also declined. The labour market has weakened, particularly in trade-intensive sectors, and unemployment has risen to 6.9%. The economy is expected to be considerably weaker in the second quarter, with the strength in exports and inventories reversing and final domestic demand remaining subdued.

CPI inflation eased to 1.7% in April, as the elimination of the federal consumer carbon tax reduced inflation by 0.6 percentage points. Excluding taxes, inflation rose 2.3% in April, slightly stronger than the Bank had expected. The Bank's preferred measures of core inflation, as well as other measures of underlying inflation, moved up. Recent surveys indicate that households continue to expect that tariffs will raise prices and many businesses say they intend to pass on the costs of higher tariffs. The Bank will be watching all these indicators closely to gauge how inflationary pressures are evolving.

With uncertainty about US tariffs still high, the Canadian economy softer but not sharply weaker, and some unexpected firmness in recent inflation data, Governing Council decided to hold the policy rate as we gain more information on US trade policy and its impacts. We will continue to assess the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs.

Governing Council is proceeding carefully, with particular attention to the risks and uncertainties facing the Canadian economy. These include: the extent to which higher US tariffs reduce demand for Canadian exports; how much this spills over into business investment, employment and household spending; how much and how quickly cost increases are passed on to consumer prices; and how inflation expectations evolve.

We are focused on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval. We will support economic growth while ensuring inflation remains well controlled.

Information note

The next scheduled date for announcing the overnight rate target is July 30, 2025. The Bank will publish its next MPR at the same time.

Source: Bank of Canada Website

Contact Sarabjit Dhuna

Please fill in all fields below