Bruce Smith

Mortgage Agent

M08009387

CENTUM Future Mortgage Group Inc.

Brokerage # 10465

Each office is independently owned and operated.

Direct

Fax

(519) 649 2598

Address

109, 411 East Main StWelland ON L3B 3X3

More About Bruce Smith

Casb Management Group Inc. operates both as a Canadian mortgage broker in London, Ontario with a primary focus on residential and investment properties in London and the area surrounding the Forest City, and as a common sense private mortgage lender in London, Ontario. Each application is considered based on a combination of income, credit and equity.

Contact one of our knowledgeable and friendly local mortgage experts today at (519) 649-2502 to get started on your path to a much more prosperous financial future!

Some of the best mortgage rates anywhere in Canada

Best 3-Year Fixed

3.75%

Best 5-Year Fixed

4.19%

Best 5-Year Variable

3.70%

Some conditions may apply. Rates may vary from Province to Province. Rates subject to change without notice. *O.A.C. E.& O.E.

Unique, innovative and trusted mortgage services

I have access to a wide and varied range of Mortgage Services to suit your exact needs. I am here to help answer any questions you might have so please feel free to contact me for more information..

Renewing Your Mortgage

Buying Your First Home

Buying Your Next Home

Reverse Mortgages

Debt Consolidation

Vacation Property

New to Canada

Mortgages for Self-Employed

Commercial Mortgages

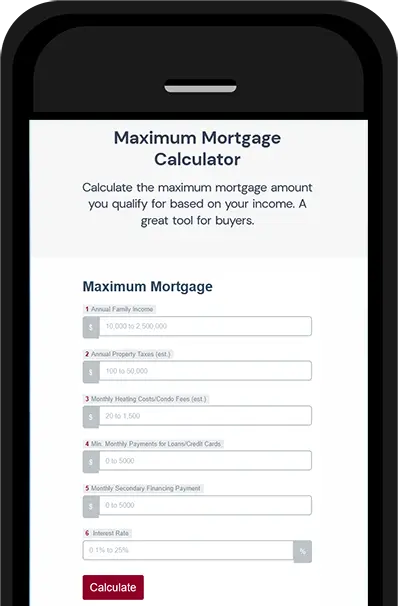

How Much Can You Afford?

Try one of my easy to use mortgage calculators to quickly and easily see what you can afford. Run payment scenarios, figure out land transfer costs, closing costs and much more!

Get Approved in 3 Easy Steps!

Find the Right Mortgage

I have access to over 50 lenders from across Canada to fit you into a mortgage solution

Tell Me Your Needs

Tell me about your financing needs so I can better understand your mortgage goals

Apply & Get Approved

Get pre-approved for your exact mortgage solution and start house shopping

Latest Blog Posts

Read More

Dec 10-2025 - Bank of Canada maintains policy rate at 2.25%

Read More

Fall 2025 Canadian Mortgage Trends & Insights Report

Insured Mortgage Rules and Affordability in 2026: A Practical Guide for Canadian Homebuyers

If you are trying to buy a home in Canada right now, you have probably felt the disconnect.

Rates are lower than they were at the peak, but affordability still feels tight. Home prices in many markets have not fallen in a way that makes things feel easy. And qualifying can still feel like a math problem with moving pieces.

That is exactly why insured mortgage rules matter more in 2026 than most buyers realize.

An insured mortgage, meaning a mortgage with less than 20% down where mortgage default insurance is required, can be a powerful tool for buyers. It can also surprise buyers who do not understand the rules, the limits, and how insurance premiums and amortization choices impact monthly payments and cash needed at closing.

This guide is designed to be practical. It will help you understand what insured mortgage rules actually mean for your buying power in 2026, and what content a broker's website should have so you can make decisions faster and with more confidence.

Why insured mortgage rules are back in focus in 2026

Even when interest rates stabilize or move down, affordability does not automatically reset. Buyers still need to qualify, manage their monthly payment, and have enough cash to close.

Insured mortgage rules impact affordability in two big ways, they can expand who qualifies with a smaller down payment, and in some cases they can reduce monthly payment pressure by allowing longer amortizations.

If you are early in your search, start with a proper mortgage pre-approval so your budget is grounded in real numbers, not guesswork.

What is an insured mortgage in plain language

In Canada, if you buy a home with a down payment of less than 20% of the purchase price, mortgage default insurance is typically required. This insurance protects the lender if the borrower defaults.

The cost is usually paid by the borrower through an insurance premium that is added to the mortgage amount, then paid off over time through your regular mortgage payments.

So the insured mortgage tradeoff looks like this:

- You can buy with a smaller down payment.

- You pay an insurance premium, which increases your total mortgage amount.

- The rules and limits are specific, and they matter for affordability.

The biggest insured mortgage shifts that affect buyers in 2026

Two program level shifts that took effect in late 2024 continue to shape affordability in 2026:

- The insured mortgage purchase price cap increased to $1.5 million.

- Access to 30-year insured amortizations was expanded for eligible first-time homebuyers and eligible buyers purchasing a new build.

These changes do not mean everyone suddenly qualifies for more. They do mean more buyers can use insured financing in markets where prices made the old cap feel limiting, and some buyers can lower the monthly payment by spreading repayment over a longer period.

If you are buying your first home, review first-time home buyer options and requirements early, before you fall in love with a property that does not fit your real budget.

The insured mortgage affordability equation, what actually moves the needle

For most buyers, affordability comes down to four levers:

- Purchase price

- Down payment

- Interest rate

- Amortization length

Insured mortgage rules affect your down payment options and, in some cases, your amortization options. They also affect your total mortgage amount because the insurance premium is usually added to the mortgage.

Why amortization matters so much

A longer amortization generally lowers the monthly payment because you are spreading repayment over more years. That can be the difference between a deal fitting your budget or not.

But there is a tradeoff. A longer amortization can mean more interest paid over time, and in some cases there may be premium surcharges associated with amortizations beyond 25 years.

The premium reality, you are paying for flexibility

Mortgage default insurance makes smaller down payments possible, but that flexibility comes at a cost. The premium increases your mortgage amount and can affect your monthly payment.

This is why side-by-side comparisons matter. You want to see how a slightly larger down payment, a shorter amortization, or a different price point changes your monthly payment and your total cost over time.

A practical insured mortgage playbook for 2026 buyers

If you are buying in 2026 and you might be using insured financing, follow this playbook. It reduces surprises and helps you shop with confidence.

Step 1, confirm if you are actually in insured territory

This is simple but important.

- Less than 20% down, you are typically in insured territory.

- 20% or more down, you are typically in uninsured territory.

Why it matters, insured and uninsured mortgages can have different qualification rules, different pricing, and different lender appetites. Even a small change in down payment can shift your options.

Step 2, use the insured price cap correctly

The insured cap matters in two ways. It expands insured eligibility in higher-priced markets, but it is still a hard ceiling. If your target price is near the upper range, you want your broker to pressure-test the numbers early.

This one step prevents a common frustration, spending weekends touring homes that do not fit the financing rules you actually need.

Step 3, ask if a 30-year insured amortization applies to your situation

Not every buyer will qualify for a 30-year insured amortization, and not every lender will offer the same path. Eligibility can depend on factors like whether you are a first-time homebuyer or whether the property is a new build.

A good broker will ask the right questions up front, then show you the payment impact and the long-term tradeoffs.

Step 4, budget for cash to close, not just the down payment

This is where buyers get caught. Your down payment is not the only money you need. Closing costs can include legal fees, land transfer tax where applicable, adjustments, and moving costs.

Insured mortgages do not eliminate closing costs. Buyers sometimes stretch for the down payment, then feel squeezed at closing. Planning for cash to close is part of making the purchase sustainable.

Step 5, decide what you are optimizing for

There is no single best mortgage structure for every buyer. In 2026, buyers generally optimize for one of three goals:

- Lowest monthly payment, often helped by longer amortization when eligible.

- Lowest total cost, often helped by shorter amortization and faster principal paydown.

- Lowest cash needed to buy, often helped by insured options, but watch the premium impact.

If you and your broker are not clear on your priority, you can end up with a mortgage structure that feels wrong, even if it gets approved.

What this means for first-time buyers, movers, and buyers close to 20% down

First-time homebuyers

First-time buyers are often the biggest beneficiaries of insured mortgage flexibility because the barrier is usually the down payment and the monthly payment. The right structure can make the first purchase feel possible without stretching your budget beyond comfort.

If you are in this category, start with the basics of the first-time buyer process, then pair it with a real pre-approval so you are shopping within the right range from day one.

Movers and buyers purchasing a new build

New builds can create unique affordability pressure because of upgrades, deposits, timelines, and closing cost planning. Even when monthly payments look manageable, timing and cash flow can be the challenge.

This is where a broker helps you plan the full picture, not just the payment.

Buyers close to 20% down

If you are sitting at 18% or 19% down, the decision to push to 20% is not always obvious.

- Staying insured might allow a faster purchase with less saving time.

- Reaching 20% down might avoid the insurance premium and change your lender options.

This is a perfect moment for a side-by-side comparison so you can see which path is actually better for your timeline and budget.

The website content your mortgage broker should have in 2026

This section is for buyers, because the right website content saves you time and protects you from bad assumptions. A strong broker website should answer common questions clearly, quickly, and in plain language.

Here is what a buyer-friendly mortgage website should include in 2026.

1) A simple insured mortgage explainer

It should clearly answer what default insurance is, who needs it, how premiums work, what the key limits are, and what choices affect monthly payment.

2) A down payment and affordability guide that reflects real Canadian rules

Not generic advice. A useful guide explains how down payment affects insured versus uninsured financing, monthly payments, and total mortgage cost.

3) A first-time homebuyer hub that answers real questions

Not just "what is a pre-approval." A useful hub explains what documents matter, what happens after you apply, how offers and conditions work, and the common mistakes that delay approvals.

4) A clear renewals and refinancing section for homeowners planning ahead

Even if you are buying now, you will eventually renew. A good website should explain how renewals work and why comparing options matters.

Refinancing is also a major affordability tool for some homeowners, whether it is debt consolidation, renovations, or restructuring the mortgage. A clear refinancing section helps homeowners understand what is possible and what to watch for.

5) Tools that make the numbers easy

Buyers want to run numbers quickly, especially when comparing price ranges or down payments. A solid set of mortgage calculators helps people self-educate, then ask better questions when they are ready to speak with a professional.

6) A clear process page that builds trust

Buyers want to know what happens after they reach out, how fast they will get an answer, and what to prepare. Clarity converts. It also reduces stress.

A realistic example, how insured rules change a buyer's outcome

Here is a scenario we see often.

A couple is buying their first home. They have solid income and stable employment, but their down payment is limited. They start shopping without clarity on insured rules and assume they need to stay under an outdated price cap, so they narrow their search too early and miss good options.

Once a broker walks them through insured qualification, how the insurance premium affects the mortgage amount, and how amortization changes the monthly payment, their plan becomes clearer. They do not automatically buy more house. They simply stop wasting weekends on homes that do not fit their real affordability range.

The outcome is confidence. They shop with a realistic budget, write stronger offers, and move to closing with fewer surprises.

The bottom line, insured mortgages can help affordability, but only if you use them intentionally

In 2026, insured mortgages are not a technical detail. They are one of the most practical tools many buyers have to enter the market, especially first-time buyers and buyers with smaller down payments.

The benefit only shows up when you understand the key limits, the tradeoffs, how premiums affect total cost, and how amortization choices change monthly payments.

If you are buying this year, the next best move is simple. Before you tour homes seriously, get a proper pre-approval, then have a broker model insured options side-by-side so you can shop with confidence instead of guessing.

FAQs

1) What is an insured mortgage in Canada?

An insured mortgage is typically a mortgage where you put less than 20% down and mortgage default insurance is required. The premium is usually added to your mortgage amount and paid over time.

2) Do insured mortgages change my monthly payment?

Yes. The insurance premium increases the total mortgage amount, which can increase the payment. On the other hand, insured options may allow you to buy sooner with a smaller down payment, and in some cases longer amortizations can reduce monthly payment pressure.

3) Can I get a 30-year amortization with an insured mortgage in 2026?

In some cases, yes. Eligibility depends on factors like whether you are a first-time homebuyer or purchasing a new build, and on the insured program and lender you are using.

4) Should I always try to reach 20% down to avoid mortgage insurance?

Not always. Avoiding the premium can reduce total cost, but waiting to save a larger down payment can delay your purchase. The right decision depends on your timeline, the market you are buying in, and how comfortable your monthly payment and cash to close will be.

5) What should I ask a broker before I start house hunting?

Ask for a clear pre-approval and a side-by-side comparison showing monthly payment and estimated cash to close under different down payment levels and amortization options, so you shop within a realistic range from day one.

Disclaimer: This article is for general informational purposes only and is not mortgage, financial, or legal advice. Mortgage rules, lender policies, and qualification requirements can vary by province, lender, and your personal situation. Always speak with a licensed Canadian mortgage professional to confirm the details that apply to you before making decisions.

Why Inflation Is Cooling but Homeownership Still Feels Expensive in Canada

If you have been watching the news, you have likely heard that inflation in Canada is coming down. That sounds like good news, especially for homeowners and buyers who have been under pressure from higher mortgage rates and rising costs. Yet for many Canadians, owning a home still feels just as expensive as ever.

So what is really going on?

The answer lies in how inflation is measured, especially when it comes to housing. While overall inflation may be easing, the costs tied directly to homeownership, such as mortgage interest, property taxes, insurance, and maintenance, are still elevated. Understanding this disconnect is critical if you are buying, renewing, refinancing, or simply trying to manage your household budget.

What "Cooling Inflation" Actually Means for Canadians

Inflation is typically measured using the Consumer Price Index, or CPI. This index tracks how prices change over time across a broad basket of goods and services, including food, transportation, clothing, and housing-related costs.

When headlines say inflation is cooling, they are referring to the overall CPI number. This does not mean every category is getting cheaper. Some categories slow down faster than others, and housing is one of the slowest to adjust.

This is why many homeowners feel confused. Gas prices may stabilize, grocery inflation may soften, but monthly housing costs can remain high or even continue rising.

Shelter Costs Are the Missing Piece Most Homeowners Overlook

Within CPI, there is a category called shelter inflation. This includes several housing-related components that directly affect homeowners and buyers.

- Mortgage interest costs

- Rent

- Property taxes and utilities

- Home insurance and maintenance

Mortgage interest costs deserve special attention. Even when inflation starts to ease, mortgage interest costs can remain high because they reflect past rate increases. In other words, homeowners renewing today are still feeling the impact of earlier Bank of Canada rate hikes.

This is one of the main reasons affordability still feels stretched, even when inflation headlines sound more optimistic.

Why Mortgage Rates Do Not Move in Lockstep With Inflation

Many homeowners assume that if inflation drops, mortgage rates will immediately follow. In reality, mortgage rates respond to a combination of factors.

Variable rates are tied more directly to the Bank of Canada's policy rate. Fixed rates, on the other hand, are influenced by bond markets and investor expectations about future inflation and economic growth.

This means inflation can cool while fixed mortgage rates remain elevated, especially if markets expect inflation to be stubborn or economic conditions to remain uncertain.

For homeowners, this creates a confusing environment where cost pressures linger even as economic indicators improve.

What This Means If You Are Buying a Home

For buyers, cooling inflation does offer some long-term optimism, but it does not automatically restore affordability overnight.

Home prices, borrowing costs, and qualification rules still play a major role. Even with inflation easing, buyers may still face stress test challenges and higher monthly payments compared to a few years ago.

This is where planning becomes essential. Understanding how your mortgage options align with your budget, future income, and risk tolerance can make a meaningful difference.

If you are actively shopping, it is worth reviewing your options with a professional who can help you navigate today's rate environment and qualification rules.

How Renewing Homeowners Are Affected Most

Mortgage renewals are where the impact of shelter inflation is felt most directly.

Many Canadians renewing now are moving from historically low rates into much higher ones. Even if inflation is cooling, the renewal payment shock can be significant.

This makes it more important than ever to review your renewal options rather than simply signing your lender's offer. Term length, fixed versus variable choices, and payment flexibility all matter in a market like this.

If your renewal is coming up, reviewing your strategy early can help reduce risk and avoid unnecessary cost increases.

Refinancing as a Tool to Manage Cost Pressure

For some homeowners, refinancing can help manage the ongoing pressure of higher shelter costs.

While refinancing does not eliminate higher rates, it can help by restructuring debt, extending amortization, or consolidating higher-interest obligations into one payment.

This approach can improve monthly cash flow, especially in households facing rising property taxes, insurance premiums, or other fixed costs.

Refinancing should always be approached carefully, with a clear understanding of long-term costs and goals. A professional review can help determine whether it makes sense in your situation.

Why Housing Supply Still Matters

Another reason affordability remains strained is housing supply. Even as inflation cools, supply constraints continue to put pressure on prices in many markets.

Construction costs, labour shortages, and zoning challenges all affect how quickly new housing comes to market. These factors are slow to change and can keep prices elevated despite improving inflation data.

For homeowners, this means housing costs remain sticky, and affordability improvements tend to be gradual rather than immediate.

What Homeowners Should Focus on Right Now

Instead of reacting to headlines alone, homeowners are better served by focusing on what they can control.

- Review your mortgage before renewal dates

- Understand how your rate type affects future payments

- Stress-test your budget for higher costs

- Seek professional advice before making changes

Cooling inflation is a positive signal, but it does not remove the need for careful planning. The households that navigate this period best are the ones that stay informed and proactive.

Frequently Asked Questions

Why does housing still feel expensive if inflation is coming down?

Because housing costs, especially mortgage interest, respond slowly to inflation changes. Past rate increases are still working their way through renewals and payments.

Will mortgage rates drop as inflation cools?

Not automatically. Fixed and variable rates depend on different factors, and rate movements can lag inflation trends.

Should I wait for inflation to fall further before buying?

Timing the market is difficult. Buyers should focus on affordability, stability, and long-term plans rather than short-term inflation data.

Is refinancing worth considering in a high-rate environment?

In some cases, yes. Refinancing can help manage cash flow or consolidate debt, but it must be evaluated carefully.

How early should I start planning my mortgage renewal?

Ideally six to twelve months before your renewal date. Early planning provides more options and reduces pressure.

Housing Supply, Affordability, and Inflation, Why Buying a Home Still Feels Hard in Canada

Housing Supply, Affordability, and Inflation, Why Buying a Home Still Feels Hard in Canada

Many Canadians were hopeful that easing inflation and early interest rate relief would make buying a home easier. Yet for first-time buyers and existing homeowners alike, affordability still feels out of reach. Even as headlines suggest improving conditions, the reality on the ground remains challenging.

The reason comes down to a combination of limited housing supply, population growth, inflation pressures, and how mortgage rates affect borrowing power. These forces are interconnected, and understanding how they work together can help buyers make more informed decisions rather than relying on headlines alone.

In this article, we break down why housing affordability remains strained across Canada, what has changed, what has not, and what buyers should realistically expect moving forward.

Why Inflation Still Matters to Homebuyers

Inflation has been one of the biggest economic stories in Canada over the past few years. While inflation has eased from its peak, it remains an important factor in housing affordability because it directly influences interest rates and household costs.

When inflation is elevated, the Bank of Canada keeps its policy rate higher to slow spending and stabilize prices. Even modest inflation above target can delay meaningful rate cuts, which affects mortgage rates and borrowing costs.

For homebuyers, this means that even if inflation is trending down, mortgage rates may not fall as quickly as expected. As a result, monthly payments remain higher than many buyers were accustomed to in the past decade.

Inflation also impacts affordability beyond interest rates. Everyday expenses such as groceries, utilities, transportation, and insurance have risen, leaving households with less room in their budgets to qualify for a mortgage.

Housing Supply Remains the Core Challenge

The most persistent issue in Canadian housing is not demand alone, it is supply. Simply put, Canada has not been building enough homes to keep up with population growth.

New housing construction faces constraints including labor shortages, higher material costs, zoning restrictions, and lengthy approval timelines. Even when demand softens temporarily, these supply limitations keep prices from falling significantly.

Population growth has added further pressure. Canada's population has increased rapidly in recent years, driven largely by immigration. New households need places to live, and when supply does not keep pace, competition remains strong.

This imbalance explains why home prices in many regions have stayed resilient even during periods of higher interest rates. Fewer listings combined with steady demand continue to support prices.

Why Lower Rates Alone Will Not Fix Affordability

Many buyers are waiting for interest rates to fall, hoping that lower rates will restore affordability. While rate cuts can help improve borrowing power, they are not a complete solution.

When mortgage rates decline, more buyers can qualify, which often increases competition. Without a meaningful increase in housing supply, lower rates can push prices higher, offsetting some of the affordability gains.

This dynamic has played out before in Canada. Periods of falling rates have frequently been followed by renewed price growth, particularly in supply constrained markets.

Affordability improves most sustainably when income growth, housing supply, and borrowing costs move in balance. Rate relief alone cannot solve structural shortages.

What This Means for First-Time Buyers

First-time buyers are facing one of the most difficult entry points in decades. Higher mortgage rates reduce qualifying amounts, while elevated home prices increase required down payments.

Government programs and incentives can help, but they do not fully bridge the gap for many households. As a result, first-time buyers often need to adjust expectations around location, home type, or timing.

Despite these challenges, opportunities still exist. Some buyers are finding success by purchasing smaller homes, considering alternative neighborhoods, or partnering with family for down payment support.

Preparation matters more than ever. Understanding credit, budgeting conservatively, and securing a strong mortgage pre-approval can make a meaningful difference in competitive situations.

What Existing Homeowners Are Experiencing

Existing homeowners face a different set of challenges. Many are renewing mortgages that were originally secured at much lower interest rates, leading to higher payments even if their loan balance has declined.

Some homeowners are delaying moves or renovations due to affordability concerns, contributing further to limited housing supply. When fewer people list their homes, inventory remains tight.

For those considering upsizing, higher borrowing costs can significantly impact monthly payments. This has caused many homeowners to stay put longer, reinforcing the supply shortage.

Refinancing options may still be available for homeowners with sufficient equity, but qualification rules are stricter and careful planning is essential.

The Role of Mortgage Rules and Qualification Stress Tests

Canada's mortgage stress test continues to play a significant role in affordability. Buyers must qualify at a higher rate than their actual contract rate, which reduces the maximum amount they can borrow.

While the stress test is designed to protect borrowers from future rate increases, it also limits purchasing power, particularly in higher priced markets.

Even if mortgage rates fall modestly, the stress test will remain a constraint for many buyers unless there are policy changes. This adds another layer to why affordability has not improved quickly.

Why Waiting Is Not Always the Answer

Many buyers are choosing to wait, hoping conditions will improve significantly. While waiting can make sense for some households, it is not a guaranteed path to better affordability.

If rates fall and demand rises without corresponding supply increases, competition may intensify. This can lead to higher prices and bidding pressure.

The right time to buy is often more about personal readiness than market timing. Stable income, manageable debt, and long-term housing needs should guide the decision.

Buyers who focus solely on predicting rates risk missing opportunities that align with their financial situation and lifestyle.

How Buyers Can Navigate Today's Market

While the market is challenging, buyers are not without options. A strategic approach can help improve outcomes even in a constrained environment.

- Understand your true affordability, not just the maximum you qualify for

- Explore different mortgage terms and structures

- Be flexible on property type or location when possible

- Work with professionals who understand current lending rules

- Plan for long-term stability rather than short-term rate movements

These steps do not eliminate affordability challenges, but they help buyers make informed decisions grounded in reality rather than speculation.

Looking Ahead for Canadian Homebuyers

Housing affordability in Canada remains under pressure because the underlying issues are structural, not temporary. Inflation trends, interest rates, housing supply, and population growth all influence outcomes.

Progress will likely be gradual rather than dramatic. Incremental improvements in rates and supply may help over time, but buyers should expect ongoing competition in many markets.

By understanding the forces at play and planning carefully, Canadian buyers can navigate today's market with confidence rather than uncertainty.

Frequently Asked Questions

Why are home prices still high even with higher interest rates?

Limited housing supply and strong demand continue to support prices, even when borrowing costs rise.

Will lower interest rates make homes more affordable?

Lower rates can help, but without more housing supply they may also increase competition and prices.

Is it better to wait to buy a home in Canada?

Waiting can make sense for some buyers, but affordability depends on personal finances, not just market timing.

How does inflation affect mortgage rates?

Inflation influences Bank of Canada policy decisions, which impact interest rates and mortgage pricing.

What can first-time buyers do to improve affordability?

Careful budgeting, flexibility on home type or location, and strong mortgage planning can help improve options.

Bank of Canada Rate Hold, What It Means for Variable Rates and 2026 Renewals

Bank of Canada Rate Hold, What It Means for Variable Rates and 2026 Renewals

When the Bank of Canada announces a rate decision, it immediately grabs headlines. But for homeowners, the real question is always the same, what does this actually mean for my mortgage?

With the Bank of Canada holding its policy rate steady in December, many Canadians are wondering how this affects variable-rate mortgages today and what it signals for mortgage renewals heading into 2026.

A rate hold does not mean nothing is happening. In fact, it often provides important clues about where mortgage rates may head next, and how borrowers should think about renewals, refinancing, and overall affordability.

What a Bank of Canada rate hold really means

When the Bank of Canada holds its policy rate, it is choosing to pause rather than raise or cut borrowing costs. This decision reflects how the central bank views inflation, economic growth, and overall financial stability at that moment.

For homeowners, the key takeaway is that a rate hold is not a promise. It is a snapshot of current conditions. The Bank is essentially saying it wants more data before making its next move.

This matters because mortgage rates, especially variable rates, are closely tied to the Bank of Canada's overnight rate.

How a rate hold affects variable-rate mortgages

Variable-rate mortgages are directly influenced by the Bank of Canada's policy rate. When rates are held, most lenders keep their prime rate unchanged, which means variable mortgage payments or interest costs typically stay the same.

For homeowners already in a variable-rate mortgage, a rate hold can bring a sense of short-term stability. Monthly payments do not increase, and borrowers get breathing room after a period of higher rates.

However, it is important to understand that a rate hold does not automatically signal that cuts are imminent. It simply means the Bank is not convinced yet that inflation risks are fully behind us.

Static payment vs adjustable payment variables

Some variable-rate mortgages have static payments, where the payment stays the same but the portion going toward interest changes. Others have adjustable payments that move up or down with rate changes.

A rate hold keeps both structures stable for now, but borrowers should still review how close they are to their trigger rate, especially if rates remain elevated longer than expected.

Why this matters for 2026 mortgage renewals

Canadians renewing in 2026 are watching rate decisions closely. Many homeowners locked into ultra-low fixed rates in 2021 and 2022 are facing significantly higher renewal rates, even with recent stabilization.

A rate hold can suggest that the Bank of Canada believes inflation is cooling but not fully under control. This can influence how lenders price both fixed and variable mortgage options going forward.

For renewal borrowers, timing and preparation are becoming more important than trying to perfectly predict rates.

Renewal strategy matters more than rate guessing

Rather than focusing on whether the next move is a cut or another hold, homeowners should focus on renewal flexibility, prepayment options, and how different terms fit their budget.

A rate hold environment often leads to lenders competing more aggressively for strong borrowers, which can create opportunities for those who prepare early.

What fixed-rate borrowers should understand

Fixed mortgage rates are not directly set by the Bank of Canada. They are influenced by bond yields and broader market expectations about inflation and economic growth.

When the Bank holds rates, it can help stabilize bond markets, but fixed rates may still move up or down based on inflation data and global economic conditions.

This is why some homeowners see fixed rates change even when the Bank of Canada does not move its policy rate.

How affordability fits into the picture

Affordability remains one of the biggest challenges for Canadian homeowners and buyers. A rate hold can prevent immediate payment shocks, but it does not undo the impact of higher rates over the past few years.

For many households, the focus is shifting toward managing cash flow, extending amortizations where possible, and reviewing refinancing options that improve monthly affordability.

This is especially important for homeowners approaching renewal who may be rolling higher interest costs into their long-term budget.

What homeowners should consider right now

- Review your current mortgage type, variable or fixed, and how it responds to rate changes

- If renewing in the next 12 to 18 months, start planning early rather than waiting

- Understand your lender's prepayment and renewal options

- Run scenarios to see how different rates impact your monthly payment

- Focus on overall affordability, not just the headline rate

Why working with a mortgage professional matters more now

In a market shaped by rate holds and uncertainty, mortgage advice matters more than ever. Online headlines rarely explain how decisions affect individual households.

A mortgage professional can help you understand how a rate hold impacts your specific situation, whether that means staying variable, switching to fixed, refinancing, or adjusting your amortization.

The goal is not to predict the Bank of Canada's next move. The goal is to make sure your mortgage still works for you regardless of what happens next.

FAQs about Bank of Canada rate holds and mortgages

1) Does a Bank of Canada rate hold mean mortgage rates will go down soon

Not necessarily. A rate hold means the Bank is waiting for more economic data. Mortgage rates can still move based on inflation trends and bond markets.

2) Will my variable mortgage payment change during a rate hold

In most cases, no. When the policy rate is held, lenders usually keep their prime rate unchanged, which keeps variable payments or interest costs stable.

3) Should I switch from variable to fixed after a rate hold

It depends on your risk tolerance, budget, and timeline. A rate hold can be a good time to review options, but switching should be based on your full financial picture.

4) How early should I prepare for a 2026 mortgage renewal

Ideally 12 months in advance. Early planning gives you more flexibility and time to compare options, rather than accepting last-minute terms.

5) Does a rate hold improve mortgage affordability

A rate hold prevents further increases, which helps with stability, but it does not reverse past rate hikes. Affordability planning is still essential.

Dec 10-2025 - Bank of Canada maintains policy rate at 2.25%

The Bank of Canada today held its target for the overnight rate at 2.25%, with the Bank Rate at 2.5% and the deposit rate at 2.20%.

Major economies around the world continue to show resilience to US trade protectionism, but uncertainty is still high. In the United States, economic growth is being supported by strong consumption and a surge in AI investment. The US government shutdown caused volatility in quarterly growth and delayed the release of some key economic data. Tariffs are causing some upward pressure on US inflation. In the euro area, economic growth has been stronger than expected, with the services sector showing particular resilience. In China, soft domestic demand, including more weakness in the housing market, is weighing on growth. Global financial conditions, oil prices, and the Canadian dollar are all roughly unchanged since the Bank's October Monetary Policy Report (MPR).

Canada's economy grew by a surprisingly strong 2.6% in the third quarter, even as final domestic demand was flat. The increase in GDP largely reflected volatility in trade. The Bank expects final domestic demand will grow in the fourth quarter, but with an anticipated decline in net exports, GDP will likely be weak. Growth is forecast to pick up in 2026, although uncertainty remains high and large swings in trade may continue to cause quarterly volatility.

Canada's labour market is showing some signs of improvement. Employment has shown solid gains in the past three months and the unemployment rate declined to 6.5% in November. Nevertheless, job markets in trade-sensitive sectors remain weak and economy-wide hiring intentions continue to be subdued.

CPI inflation slowed to 2.2% in October, as gasoline prices fell and food prices rose more slowly. CPI inflation has been close to the 2% target for more than a year, while measures of core inflation remain in the range of 2½% to 3%. The Bank assesses that underlying inflation is still around 2½%. In the near term, CPI inflation is likely to be higher due to the effects of last year's GST/HST holiday on the prices of some goods and services. Looking through this choppiness, the Bank expects ongoing economic slack to roughly offset cost pressures associated with the reconfiguration of trade, keeping CPI inflation close to the 2% target.

If inflation and economic activity evolve broadly in line with the October projection, Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment. Uncertainty remains elevated. If the outlook changes, we are prepared to respond. The Bank is focused on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval.

Information note

The next scheduled date for announcing the overnight rate target is January 28, 2026. The Bank's next MPR will be released at the same time.

Fall 2025 Canadian Mortgage Trends & Insights Report

Did You Know ?

Did you know that despite encouraging signs of stabilization in the Canadian mortgage market this fall, the national household debt-to-income ratio remained at an eye-opening 181.8 % in Q2 of 2025, reversing seven straight quarters of decline? That's right, for every dollar of disposable income Canadian households had in that quarter, there was about $1.82 of debt. (Source: Canada Mortgage and Housing Corporation (CMHC) Fall 2025 Report) And while the national mortgage delinquency rate dipped slightly, one province, Ontario, saw an alarming year-over-year jump of 44 %, rising to 0.23 % in Q2 2025. These figures are prompting mortgage professionals, lenders and borrowers alike to take a closer look at the underlying trends. So the question isn't just "What's happening?" but rather "What does this mean for homeowners, borrowers, and advisors in the months ahead?"

Introduction

As our team of seasoned advisors working with clients across Canada, we've been monitoring the fall edition of CMHC's Residential Mortgage Industry Report (RMIR) very closely. The latest findings give us important signals, both cautionary and opportunistic, about borrower behaviour, lender activity, and macro-housing finance risk in the Canadian market. In this blog post, we'll walk through the key themes from the report, offer context, interpret what it means for mortgage clients, and provide actionable takeaways for homeowners, borrowers, and industry professionals alike. Our aim is to build trust, transparency and forward-looking guidance, so you can navigate the mortgage landscape with confidence and clarity.

Key Insights from the Fall 2025 Report

The full RMIR provides a rich set of data and trends. Here are some of the most noteworthy themes for this fall:

- Borrower behaviour is shifting. After a period of strong interest in variable-rate mortgages, we are seeing a rebound in fixed-rate 3 to 5 year terms. At chartered banks, fixed-rate mortgages with 3 to less than 5 year terms reached 43 % of newly extended mortgages in August 2025.

- Mortgage debt is rising again. Total residential mortgage debt in Canada reached about $2.3 trillion by August 2025, up 4.8 % from a year earlier.

- Household leverage remains elevated. The household debt-to-disposable-income ratio stood at 181.8 % in Q2 2025, after seven quarters of decline.

- Delinquency and stress are regionally uneven. National mortgage delinquency rates dipped slightly, but Ontario's delinquency rate rose 44 % year-over-year to 0.23 % in Q2 2025, with Toronto at 0.24 %.

- Lenders' market shares are shifting. The Big 6 banks increased their market share of originated mortgages to about 59 %, driven in part by consolidation such as Royal Bank of Canada's acquisition of HSBC Bank Canada.

- Originations grew. The first half of 2025 saw mortgage originations, purchases, refinances and switches, grow compared with the same period in 2024, helped by increases in insured mortgages and refinances.

Context & What It Means

Putting the data into perspective, what is behind these trends and how should borrowers and advisors think about them?

First, the rebound in fixed rate mortgages suggests that borrowers are seeking stability in uncertain economic times. With interest rate expectations becoming more volatile, the appeal of locking in a fixed payment is understandable. This has implications for mortgage planning, borrowers who locked into shorter-term fixed or variable rates earlier may now face rate renewal shock or shifting options.

Second, mortgage debt growth and elevated leverage highlight potential vulnerability. While debt levels improved for several quarters, the rebound means many households are still holding large debt burdens relative to income. That matters because when interest rates rise or economic growth slows, servicing that debt becomes more challenging.

Third, the regional variation matters. A national delinquency rate of approximately 0.22 % might look benign on the surface, but when a major province registers a 44 % increase year-over-year, the risk becomes more tangible. Advisors and borrowers must consider local market conditions, not just national averages.

Fourth, lender consolidation and market share shifts indicate competitive pressure and changing dynamics in the industry. For clients, this means fewer but larger players, which could impact product offerings, service levels, and negotiation power.

Finally, the growth in originations suggests that despite headwinds, there remains demand, both for purchase and refinance. That is a positive sign, but it also means the tailwinds may mask underlying risk if household finances weaken.

What Homeowners and Borrowers Should Do

Based on these insights, here is a suggested action plan for Canadian homeowners and borrowers:

- Review your renewal timeline and assess whether your current term and rate remain appropriate in this environment.

- Reassess your debt load and serviceability in light of possible rate increases or income changes.

- Consider longer-term fixed rates if you value payment certainty and are concerned about rate volatility.

- Stay aware of local market conditions and do not rely solely on national figures.

- Engage early with a trusted advisor to explore your options.

- Maintain a financial buffer for unexpected changes or rising costs.

Stats Section

Key indicators highlighting Canada's current mortgage environment:

- Residential mortgage debt of approximately $2.3 trillion.

- Household debt-to-disposable-income ratio of 181.8 %.

- Household debt-to-GDP ratio of 100.2 %.

- 43 % of new mortgages at chartered banks were 3 to 5 year fixed terms.

- Ontario delinquency rate increased to 0.23 %.

- Big 6 banks now hold approximately 59 % market share of new mortgage originations.

Top 10 FAQs

- Is now a good time to lock in a fixed-rate mortgage? It may be smart for payment certainty if volatility concerns you.

- Should I worry about national debt ratios? Focus on your personal debt position.

- Are regional markets safe? Not all regions perform equally.

- How does consolidation affect me? It may reduce product variety.

- What should I do before renewal? Plan early and review options.

- Are long amortizations risky? They increase long-term interest.

- Does region affect risk? Yes, significantly.

- How to protect from rate rises? Stress test your budget.

- Are variable rates risky? They carry uncertainty.

- How should advisors guide clients? Focus on transparency and risk awareness.

Final Thoughts

Our team, we believe well-informed clients make better decisions. The Fall 2025 CMHC report shows a mix of stability and caution. While the market is not in crisis, it is evolving and requires thoughtful planning.

Now is the time for homeowners to review mortgage strategies, assess risk, and prepare for upcoming renewals. With clarity, planning and professional guidance, the path forward can remain secure and confident.

Contact Bruce Smith

Please fill in all fields below