Mitra Knight

Mortgage Agent

CENTUM Elite Mortgage Corp.

Direct

Fax

(780) 435 0100

Address

#301, 11044 – 82 AvenueEdmonton AB T6G 0T2

More About Mitra Knight

I'm dedicated to guiding you through the mortgage process with ease and ensuring you’re fully informed about your options, whether you’re purchasing, renewing or refinancing. I take pride in my ability to communicate complex financial concepts in a way that’s easy for everyone to understand.

Purchasing a home can be a stressful experience, which is why I strive to make the process of securing a mortgage as seamless and stress-free as possible. Whether you’re a first-time homebuyer or a seasoned homeowner, I’m committed to finding the mortgage solution that best meets your unique needs.

If you need real estate financing in Edmonton or the surrounding area, I’d love to work with you!

Some of the best mortgage rates anywhere in Canada

Best 3-Year Fixed

3.90%

Best 5-Year Fixed

4.14%

Best 5-Year Variable

3.75%

Some conditions may apply. Rates may vary from Province to Province. Rates subject to change without notice. *O.A.C. E.& O.E.

Unique, innovative and trusted mortgage services

I have access to a wide and varied range of Mortgage Services to suit your exact needs. I am here to help answer any questions you might have so please feel free to contact me for more information..

Renewing Your Mortgage

Buying Your First Home

Buying Your Next Home

Reverse Mortgages

Debt Consolidation

Vacation Property

New to Canada

Mortgages for Self-Employed

Commercial Mortgages

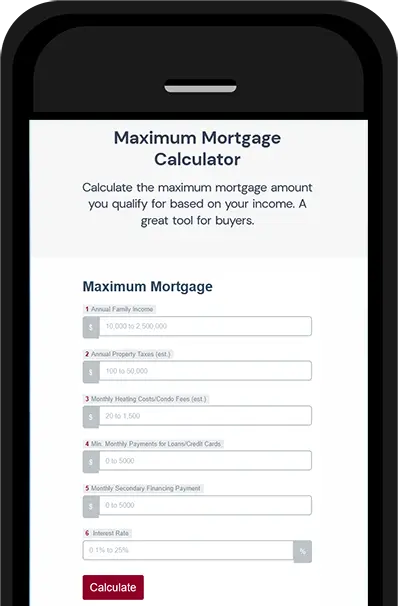

How Much Can You Afford?

Try one of my easy to use mortgage calculators to quickly and easily see what you can afford. Run payment scenarios, figure out land transfer costs, closing costs and much more!

Get Approved in 3 Easy Steps!

Find the Right Mortgage

I have access to over 50 lenders from across Canada to fit you into a mortgage solution

Tell Me Your Needs

Tell me about your financing needs so I can better understand your mortgage goals

Apply & Get Approved

Get pre-approved for your exact mortgage solution and start house shopping

Latest Blog Posts

Read More

Bank of Canada lowers policy rate to 2.25%

Read More

Canadian Home Sales Poised for a Strong Finish in 2025

Read More

September 17-2025 - Bank of Canada lowers policy rate to 2.5%

Read More

CMHC - Monthly Housing Starts - July 2025

Nov. 2025 - How the Bank of Canada Rate Cut Affects Your Refinancing Strategy

On October 29 2025, the Bank of Canada (BoC) reduced its target overnight rate by 25 basis points to 2.25 %. For Canadian homeowners who are thinking about refinancing their mortgage, this move matters-potentially changing the cost, timing and type of mortgage strategy you choose.

Understanding What the Rate Cut Means

When the BoC lowers its policy rate, it influences short-term borrowing costs, prime rates, and indirectly the mortgage market. But the impact is not uniform-fixed-rate and variable-rate mortgages may respond differently.

Here are the key facts:

- The BoC's overnight rate target is now **2.25%**, down from 2.50%.

- This is the second consecutive cut in recent months.

- The Bank noted that the economy is showing signs of structural adjustment, including weaker growth and trade impacts, and believes the current rate is "about the right level" if inflation and activity follow their outlook.

- Forecasts from Canadian banks suggest the rate may hold around this level (2.25%) for some time rather than falling much further.

What This Means for Refinancing Your Mortgage

If you hold a mortgage in Canada and are considering refinancing, now is a timely moment to review your strategy. Here's how the rate cut could create opportunities, or signal caution.

1. Variable-rate mortgages become more attractive

Because variable-rate mortgages are typically tied to the prime rate (which tends to follow the BoC's policy rate), a drop in the policy rate often means your variable mortgage payments may drop, or more of your payment goes toward principal.

If you currently have a variable-rate mortgage or are considering switching to one during refinancing, this cut suggests you might benefit from lower monthly payments, provided you're comfortable with the variable-rate risk (i.e., rates could go up in future). For example, one industry note highlighted that a 25 bps cut could translate into "roughly $12.50/month savings per $100,000 of mortgage debt," depending on amortization and other factors.

2. Fixed-rate mortgages: timing and expectations

If you hold or are thinking of a fixed-rate mortgage, the impact is more muted. Fixed rates are driven by bond yields, lender margins and expectations for future rate changes. A policy rate cut doesn't immediately guarantee a lower fixed mortgage rate.

According to the BoC's own analytical note, about 60 % of Canadian mortgage holders renewing in 2025–2026 may still face increased payments compared with December 2024, even in a lower rate environment-particularly those with five-year fixed terms.

For refinancing a fixed-rate mortgage, you should compare the current fixed-rate product with your renewal or payout penalties, amortization remaining, and overall cost. If fixed rates remain high relative to where you could lock in, there may still be value-but the "cheap refinance" window may not be as wide as with variables.

3. Shorter-term vs longer-term amortization

When refinancing, you also consider amortization length. Lower interest rates, or the expectation of stable/lower rates-can allow you to shorten your amortization without significantly raising payments, or keep payments similar while reducing total interest cost.

For example: if refinancing and moving some of the equity (or cash-out) you could take advantage of a lower rate environment to set a schedule that better aligns with your long-term goals, such as eliminating the mortgage sooner and freeing up more monthly cash flow for other objectives (like your health and fitness goals, investment or retirement planning).

Three Scenarios for Homeowners

Let's walk through practical scenarios you or your clients might face, and how the rate cut changes the decision-tree.

Scenario A: You have a variable-rate mortgage and you're approaching renewal

If your mortgage is variable and you're about to renew (or switch lender) as part of refinancing, the rate cut is good news. Lower policy rate → likely lower prime → more favourable variable payments.

Action plan: review your current payment vs projected payment; ask your broker what current lender prime-based variable rates are; consider whether you expect rates to go up in the medium term (and if you're comfortable staying variable). If you expect rates to stay low for a prolonged period, staying variable or refinancing into a variable product might make sense.

Scenario B: You have a fixed-rate mortgage with a few years left and are thinking of breaking it or refinancing into another fixed term

If you hold a fixed-rate mortgage, the rate cut matters less immediately, but it still influences your expectations for future fixed rates. If lenders anticipate no further big cuts, fixed rates might not fall significantly, so waiting may not bring much benefit.

Action plan: evaluate the payout penalty; compare current available fixed terms; check how much you'd save by refinancing vs staying; assess your risk tolerance. If you have 2-3 years left, sometimes staying might be best. If you have 8-12 years left amortization or large balance, refinancing could still help lock in a strong rate.

Scenario C: You're looking to refinance and take cash-out (e.g., home equity lines, consolidations) and you're flexible

In a lower rate environment, refinancing with cash-out becomes more attractive because the interest cost is cheaper-especially if you can keep amortization manageable. Given the BoC has cut to 2.25% and signalled that it may hold there, you may have a "window" for locking favourable terms.

Action plan: assess how much equity you have, your amortization remaining, and the purpose of the cash-out. Make sure you're not extending your amortization unwisely (especially if your goal is debt reduction). Always compare rates, plus any fees or closing costs, against the benefit of doing the refinance now.

What to Watch and What Could Go Wrong

Refinancing isn't always a straightforward "yes" when rates drop. Here are some risks and factors to consider.

- Payout penalties or prepaid interest: Breaking a mortgage early often incurs costs; the rate drop may not offset that unless the savings are substantial.

- Rate floor or fixed-term lag: Just because the BoC cut the overnight rate doesn't guarantee fixed-term mortgage rates will drop equivalently or immediately.

- Shorter amortization means higher payments: If you decide to shorten amortization during refinancing, your monthly payment may rise even if the rate falls.

- Variable risk remains: Choosing a variable rate means you're exposed to future rate hikes, if the economy surprises on inflation or growth, the risk may increase.

- Market expectations: Some forecasts suggest the 2.25% policy rate may hold for some time, meaning large further cuts may not be forthcoming.

Refinancing Checklist for Canadian Homeowners

Here is a practical checklist to run through when considering refinancing in light of this recent rate cut:

- Review your current mortgage term, rate, amortization, payment and balance.

- Check how many years remain on your amortization and how many renewals you anticipate.

- Calculate your payout penalty (for fixed term) or any other costs involved.

- Check the current variable and fixed mortgage rate offers in your region/lender network.

- Estimate your new monthly payment (or compare payment change) under the refinanced amount/amortization.

- Decide whether your goal is lower monthly payment, shorter amortization, cash-out, or a combination.

- Consider your risk tolerance: are you comfortable staying variable, or prefer locking fixed now?

- Consult a trusted mortgage broker (licensed in your province) who can shop options and provide up-to-date terms.

Top 5 FAQs Canadian Homeowners Ask About This Rate Cut

Here are the most common questions we're seeing, and the answers.

- Q 1: Will my mortgage rate automatically go down because of the BoC cut?

If you have a variable-rate mortgage with payments that adjust, your rate may decrease-but fixed-rate mortgages don't change automatically. You still need to check with your lender and consider refinancing or renewal. - Q 2: Is now the best time to refinance?

It could be a strong time, especially if you're variable or your fixed rate is relatively high. However, you need to factor in your payout costs, time remaining, new amortization and your overall financial goals. - Q 3: Should I switch from fixed to variable now?

That depends on your risk tolerance. The rate cut makes variable mortgages more appealing, but they carry the risk of future rate increases. If you prefer stability, staying fixed might still make sense. - Q 4: Are further rate cuts likely?

The BoC signalled that the current policy rate is "about the right level" if the outlook holds, which may suggest fewer big cuts ahead. - Q 5: How much could I save by refinancing?

Savings depend on your balance, amortization, new rate and costs. As one benchmark, tighter policy-rates could reduce variable mortgage payments modestly (e.g., the "$12.50 per $100,000" figure noted in industry commentary) but you must calculate based on your specific numbers.

Conclusion: What Should You Do Now?

The October 2025 rate cut by the Bank of Canada to 2.25% is a meaningful signal for Canadian homeowners: it suggests that borrowing costs may be more favourable than earlier in the year, particularly for variable-rate mortgages, and it provides an opening to reassess your refinancing strategy.

If you're approaching renewal, have a variable mortgage, or are considering cash-out or a shorter amortization, this is a timely moment to talk to your mortgage broker and review your position. On the other hand, if you're locked into a fixed rate with only a short term remaining, the benefits may be less dramatic, but still worth examining.

In short: use this rate cut as a trigger to run the numbers, compare your options, and align your mortgage strategy with your financial goals-whether that's reducing your monthly payment, paying off your home faster, or freeing up cash flow for other priorities.

Need help? Our team specializes in Canadian mortgages and can review your renewal or refinance options tailored to your province, property type and long-term goals. Reach out today.

Bank of Canada lowers policy rate to 2.25%

The Bank of Canada today reduced its target for the overnight rate by 25 basis points to 2.25%, with the Bank Rate at 2.5% and the deposit rate at 2.20%.

With the effects of US trade actions on economic growth and inflation somewhat clearer, the Bank has returned to its usual practice of providing a projection for the global and Canadian economies in this Monetary Policy Report (MPR). Because US trade policy remains unpredictable and uncertainty is still higher than normal, this projection is subject to a wider-than-usual range of risks.

While the global economy has been resilient to the historic rise in US tariffs, the impact is becoming more evident. Trade relationships are being reconfigured and ongoing trade tensions are dampening investment in many countries. In the MPR projection, the global economy slows from about 3¼% in 2025 to about 3% in 2026 and 2027.

In the United States, economic activity has been strong, supported by the boom in AI investment. At the same time, employment growth has slowed and tariffs have started to push up consumer prices. Growth in the euro area is decelerating due to weaker exports and slowing domestic demand. In China, lower exports to the United States have been offset by higher exports to other countries, but business investment has weakened. Global financial conditions have eased further since July and oil prices have been fairly stable. The Canadian dollar has depreciated slightly against the US dollar.

Canada's economy contracted by 1.6% in the second quarter, reflecting a drop in exports and weak business investment amid heightened uncertainty. Meanwhile, household spending grew at a healthy pace. US trade actions and related uncertainty are having severe effects on targeted sectors including autos, steel, aluminum, and lumber. As a result, GDP growth is expected to be weak in the second half of the year. Growth will get some support from rising consumer and government spending and residential investment, and then pick up gradually as exports and business investment begin to recover.

Canada's labour market remains soft. Employment gains in September followed two months of sizeable losses. Job losses continue to build in trade-sensitive sectors and hiring has been weak across the economy. The unemployment rate remained at 7.1% in September and wage growth has slowed. Slower population growth means fewer new jobs are needed to keep the employment rate steady.

The Bank projects GDP will grow by 1.2% in 2025, 1.1% in 2026 and 1.6% in 2027. On a quarterly basis, growth strengthens in 2026 after a weak second half of this year. Excess capacity in the economy is expected to persist and be taken up gradually.

CPI inflation was 2.4% in September, slightly higher than the Bank had anticipated. Inflation excluding taxes was 2.9%. The Bank's preferred measures of core inflation have been sticky around 3%. Expanding the range of indicators to include alternative measures of core inflation and the distribution of price changes among CPI components suggests underlying inflation remains around 2½%. The Bank expects inflationary pressures to ease in the months ahead and CPI inflation to remain near 2% over the projection horizon.

With ongoing weakness in the economy and inflation expected to remain close to the 2% target, Governing Council decided to cut the policy rate by 25 basis points. If inflation and economic activity evolve broadly in line with the October projection, Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment. If the outlook changes, we are prepared to respond. Governing Council will be assessing incoming data carefully relative to the Bank's forecast.

The Canadian economy faces a difficult transition. The structural damage caused by the trade conflict reduces the capacity of the economy and adds costs. This limits the role that monetary policy can play to boost demand while maintaining low inflation. The Bank is focused on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval.

Information note

The next scheduled date for announcing the overnight rate target is December 10, 2025. The Bank's next MPR will be released on January 28, 2026.

Canadian Home Sales Poised for a Strong Finish in 2025

The Canadian housing market is showing signs of renewed strength as we approach the end of 2025. According to the latest report from the Canadian Real Estate Association (CREA), home sales across the country are on track for a strong finish to the year, buoyed by lower borrowing costs, improving consumer confidence, and a more balanced market.

A Shift Toward Market Stability

After several years of adjustment, the national housing market appears to be finding its footing once again. CREA's data shows that both home sales and average prices have been steadily improving in most major markets. This rebound comes as many buyers and sellers regain confidence, encouraged by recent interest rate reductions and a more predictable lending environment.

While the pace of growth varies from region to region, markets that experienced the sharpest slowdowns during the high-rate period-such as Ontario and British Columbia-are now seeing a modest recovery. Meanwhile, more affordable provinces like Alberta, Saskatchewan, and parts of Atlantic Canada continue to attract strong demand from both first-time buyers and relocating families.

Interest Rate Cuts Helping Buyers Re-Enter the Market

One of the key drivers behind the recent uptick in activity is the Bank of Canada's move to gradually reduce interest rates in 2025. These rate cuts have helped improve affordability for many households that had been priced out of the market in previous years. Lower rates mean lower monthly mortgage payments, allowing buyers to stretch their budgets a little further and renew their homeownership goals.

For existing homeowners, refinancing or renewing at a lower rate has also provided some much-needed financial relief, especially after several years of rising costs. Mortgage professionals across the country are reporting an increase in consultations as clients explore opportunities to secure better terms or plan their next purchase.

National Home Prices Showing Modest Gains

CREA's latest figures indicate that the national average home price has been edging upward in recent months. While prices remain below their 2022 peaks, the stabilization is a positive sign for both homeowners and the broader economy. This trend suggests that Canada's housing market is entering a healthier phase, where prices are more closely aligned with fundamentals like income growth and supply levels.

Balanced conditions in many cities are also giving buyers more time and choice. This shift away from the intense bidding wars of past years has created opportunities for well-qualified buyers to negotiate favourable terms and find homes that truly meet their needs.

Supply Levels Still a Key Factor

Despite the encouraging rebound in sales, Canada continues to face a structural shortage of housing supply. CREA notes that new listings have increased slightly, but the number of available homes remains below long-term averages in many markets. Population growth and continued immigration are putting added pressure on supply, highlighting the need for ongoing construction and development across the country.

Federal and provincial housing initiatives are expected to play a vital role in addressing this imbalance. As new housing projects move forward, more inventory could help keep price growth sustainable in 2026 and beyond.

What This Means for Buyers and Homeowners

For Canadians thinking about buying, selling, or refinancing, the current market presents a window of opportunity. Lower interest rates, stable prices, and growing confidence are combining to create favourable conditions for those ready to make a move. Whether you're entering the market for the first time, upgrading to a larger home, or considering an investment property, understanding your financing options is more important than ever.

Working with an experienced mortgage broker can help you navigate the changing landscape, compare lenders, and find a solution that fits your budget and long-term goals. A broker can also assist with pre-approvals, rate holds, and refinancing strategies designed to take advantage of today's improving conditions.

Looking Ahead to 2026

As CREA forecasts continued stability into early 2026, most experts agree that Canada's housing market is transitioning into a more balanced and sustainable environment. While challenges remain-especially around supply and affordability-the overall outlook is more optimistic than it has been in several years.

If you've been waiting for the right moment to act, now may be an ideal time to review your mortgage options and prepare for what's ahead. Reach out to a licensed mortgage professional in your area to discuss how today's market trends could work in your favour.

Sources

Data and insights referenced in this article are based on the October 2025 housing market update from the Canadian Real Estate Association (CREA).

How Falling Rates Open Doors for Gig Workers, Mortgages for Non-Traditional Incomes

After several policy cuts, the Bank of Canada's overnight rate sits at 2.50% as of September 17, 2025, down from 3.00% in January. This easing has lowered borrowing costs and improved affordability signals for many buyers, including freelancers and gig workers who have struggled to qualify in recent years.

What the rate cuts really change

Lower policy rates flow through to fixed and variable mortgage pricing, which can reduce stress on monthly payments. Even with the drop, borrowers still need to pass Canada's minimum qualifying rate that remains the greater of the contract rate plus 2% or 5.25% for uninsured mortgages. That rule continues to govern how banks test affordability, so clients benefit from lower contract rates, but must still meet this buffer.

Why this matters for gig-economy buyers

Gig and self-employed income often fluctuates month to month. When rates fall, two things help:

- Lower payments, which improve debt-service ratios.

- More competitive pricing, which can make a borderline file work once strong documentation is in place.

Canada's gig and self-employment footprint is significant, with recent research highlighting the need for financing pathways that reflect modern earning patterns.

How lenders actually assess non-traditional income

Most mainstream lenders look for stability and a track record. A common approach is to average two years of self-employed income using T1 Generals and Notices of Assessment, along with business statements and, where relevant, T2125 forms. Canada's national housing agency also provides a self-employed pathway under its mortgage loan insurance, which recognizes different forms of self-employment and outlines documentation flexibility, especially around the 24-month mark in the same field or operation.

Documents that strengthen a file

- T1 Generals and Notices of Assessment for the last two years

- Statement of Business or Professional Activities, T2125 when applicable

- Business financial statements and recent bank statements

- Proof of active contracts or retainers, invoices, and receivables logs

- A short, factual income narrative that explains seasonality and trends

A-lenders vs alternative lenders

- A-lenders, banks and credit unions, usually require the full two-year documentation trail and clean ratios under the qualifying rate.

- Alternative lenders can consider enhanced bank-statement programs and other documentation that shows cash flow when tax-reported income looks modest due to deductions. These programs vary by lender and can be a bridge for solid borrowers who need a different way to show strength.

The stress test today, and what could change

For now, the stress test rule for uninsured mortgages is unchanged. There has been policy discussion about supplementing or replacing parts of the test with loan-to-income style measures in the future. If adopted, that would adjust how lenders look at higher leverage files. It is a space to watch, but nothing has replaced the current qualifying rate at the time of writing.

Actionable steps for gig-economy clients in a falling-rate window

-

Get a quick affordability check under the current qualifying rate

Ask your broker to test your profile at your likely contract rate plus 2% and at 5.25%, then use the higher figure. This sets a realistic ceiling while rates are favourable.

-

Build a clean 24-month income story

Two full tax years with matching bank activity and business records carry weight. If you started recently, but have prior experience in the same line of work, note that some insured options recognize this on a case by case basis.

-

Stabilize your cash flow on paper

Use recurring contracts, retainers, or platform statements to show predictable earnings. Flag large one-time spikes and document them. Lenders ask about variance and trend, not just totals.

-

Track expenses and add-backs carefully

Many self-employed Canadians reduce taxable income with legitimate deductions, which can depress the income that qualifies for a mortgage. Work with an accountant to present a balanced picture that reflects true earning power without creating gaps in the story.

-

Keep a liquidity buffer

Three to six months of housing costs in savings can help an underwriter get comfortable with variable income. It also protects you if revenue dips.

-

Consider the product mix

Variable rate can see quicker payment relief when policy rates fall, but payments still must pass the qualifying test. Fixed rate provides certainty, which can be useful if your income seasonality is pronounced.

-

Mind the renewal math

Even with lower rates today, plan ahead for renewal by revisiting your documents every year. A strong file at renewal gives you leverage to shop the market. The Bank of Canada decision calendar is public, so you can time reviews around scheduled announcements.

Examples that illustrate the impact

Example 1, Solo freelancer with seasonal spikes

A graphic designer earns $92,000 one year and $78,000 the next. Averaged income is $85,000. With policy-driven rate relief, the designer's target five-year fixed quote improves, which helps the designer pass the stress test when combined with documented retainers from three recurring clients and six months of bank statements that align with invoices. The self-employed pathway supports recognition of the business history and provides a clear checklist of documents.

Example 2, Multi-stream gig earner using an alternative program

A rideshare driver who also tutors online shows strong monthly deposits, but lower taxable income after expenses. An alternative lender reviews 12 months of bank statements plus a letter summarizing platform earnings, which can qualify the borrower at a slightly higher rate than a major bank, yet still within budget due to the broader market rate decline. Program availability varies by lender and region, so a broker comparison is important.

What to watch next

- Bank of Canada guidance through year end. A further cut would support affordability, while a hold would still leave rates below 2024 peaks.

- Regulatory developments from OSFI. Any shift toward loan-to-income limits would change how high leverage applications are structured, especially for variable earners.

- Labour market trends in gig work and self-employment. Ongoing research helps quantify this segment and informs lender policy.

Bottom line for clients

Falling rates have created a more forgiving backdrop, but documentation still decides outcomes for gig-economy buyers. If you collect the right records, keep your cash flow steady on paper, and choose the right lender channel, you can turn flexible income into a strong approval profile under today's rules. Start with a pre-approval that uses the current qualifying rate, then build your file toward the clearest 24-month story you can present.

September 17-2025 - Bank of Canada lowers policy rate to 2.5%

The Bank of Canada today reduced its target for the overnight rate by 25 basis points to 2.5%, with the Bank Rate at 2.75% and the deposit rate at 2.45%.

After remaining resilient to sharply higher US tariffs and ongoing uncertainty, global economic growth is showing signs of slowing. In the United States, business investment has been strong but consumers are cautious and employment gains have slowed. US inflation has picked up in recent months as businesses appear to be passing on some tariff costs to consumer prices. Growth in the euro area has moderated as US tariffs affect trade. China's economy held up in the first half of the year but growth appears to be softening as investment weakens. Global oil prices are close to their levels assumed in the July Monetary Policy Report (MPR). Financial conditions have eased further, with higher equity prices and lower bond yields. Canada's exchange rate has been stable relative to the US dollar.

Canada's GDP declined by about 1½% in the second quarter, as expected, with tariffs and trade uncertainty weighing heavily on economic activity. Exports fell by 27% in the second quarter, a sharp reversal from first-quarter gains when companies were rushing orders to get ahead of tariffs. Business investment also declined in the second quarter. Consumption and housing activity both grew at a healthy pace. In the months ahead, slow population growth and the weakness in the labour market will likely weigh on household spending.

Employment has declined in the past two months since the Bank's July MPR was published. Job losses have largely been concentrated in trade-sensitive sectors, while employment growth in the rest of the economy has slowed, reflecting weak hiring intentions. The unemployment rate has moved up since March, hitting 7.1% in August, and wage growth has continued to ease.

CPI inflation was 1.9% in August, the same as at the time of the July MPR. Excluding taxes, inflation was 2.4%. Preferred measures of core inflation have been around 3% in recent months, but on a monthly basis the upward momentum seen earlier this year has dissipated. A broader range of indicators, including alternative measures of core inflation and the distribution of price changes across CPI components, continue to suggest underlying inflation is running around 2½%. The federal government's recent decision to remove most retaliatory tariffs on imported goods from the US will mean less upward pressure on the prices of these goods going forward.

With a weaker economy and less upside risk to inflation, Governing Council judged that a reduction in the policy rate was appropriate to better balance the risks. Looking ahead, the disruptive effects of shifts in trade will continue to add costs even as they weigh on economic activity. Governing Council is proceeding carefully, with particular attention to the risks and uncertainties. Governing Council will be assessing how exports evolve in the face of US tariffs and changing trade relationships; how much this spills over into business investment, employment, and household spending; how the cost effects of trade disruptions and reconfigured supply chains are passed on to consumer prices; and how inflation expectations evolve.

The Bank is focused on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval. We will support economic growth while ensuring inflation remains well controlled.

CMHC - Monthly Housing Starts - July 2025

Canadian Monthly Housing Starts and Other Construction Data Tables - July 2025

At our mortgage brokerage, we make it a priority to follow the Canada Mortgage and Housing Corporation's (CMHC) monthly housing starts data. These figures aren't just numbers, they reflect the health of Canada's housing market and give homebuyers, sellers, and investors valuable insight into supply, demand, and future opportunities.

The July 2025 report shows notable shifts across the country, and we're here to break down what it means for you.

Key Highlights - July 2025

- Six-Month Trend (SAAR)

The six-month moving average of the seasonally adjusted annual rate (SAAR) of total housing starts climbed 3.7% in July to 263,088 units. This upward momentum highlights the resiliency of Canada's construction sector.

- Monthly Seasonally Adjusted Annual Rate (SAAR)

The standalone SAAR rose 4% from 283,523 in June to 294,085 units in July.

Urban centres (pop. 10,000+) saw a 5% increase to 273,618 units.

Rural starts accounted for 20,467 units.

- Year-Over-Year (YoY) Actual Starts (Centres, pop. 10K+)

Canada recorded 23,464 actual housing starts in July, a 4% increase from 22,610 a year ago. Year-to-date, the total stands at 137,875 starts, also up 4% compared to 2024.

- Regional Highlights

Montréal: Surged with a 212% YoY increase, largely driven by multi-unit projects.

Vancouver: Posted a solid 24% YoY gain, reflecting continued multi-unit demand.

Toronto: Fell sharply with a 69% YoY decline, showing weakness in both single-detached and multi-unit segments.

Broader Canadian Market Context

Housing starts continue to show strength across Canada, with multi-unit activity leading the way. Markets such as Québec and the Maritimes are seeing outsized growth.

Demand for rental housing, demographic shifts, and earlier permit approvals are fueling these numbers. However, slowing population growth and higher vacancy rates could temper activity in 2026.

What This Means for Our Clients

For Buyers and Investors: In markets like Montréal and Vancouver, new supply means more opportunities to purchase condos, townhomes, and investment properties. Toronto's dip in starts, however, signals tighter supply, which could keep prices elevated.

For Sellers: Sellers in growth regions may face more competition from new builds, while Toronto sellers may continue to benefit from limited supply.

For Developers and Builders: Strong multi-unit activity presents opportunities for construction financing. Still, every region carries unique risks, so it's important to structure financing carefully.

For Families Planning Ahead: Keep in mind that today's starts will take months, if not years, to translate into completed homes. For clients considering pre-construction purchases or development mortgages, timing is critical.

Quick Snapshot - July 2025

| Metric | July 2025 | Change (YoY / MoM) |

|---|---|---|

| Six-Month Trend SAAR | 263,088 units | +3.7% from June |

| Total Monthly SAAR | 294,085 units | +4% from June |

| Urban (pop. 10K+) SAAR | 273,618 units | +5% |

| Rural SAAR | 20,467 units | - |

| Actual Starts (pop. 10K+ centres) | 23,464 units | +4% vs July 2024 |

| Year-to-Date Actual Starts | 137,875 units | +4% |

| Montréal YoY Growth | +212% | - |

| Vancouver YoY Growth | +24% | - |

| Toronto YoY Decline | -69% | - |

What's Next?

The July 2025 CMHC housing starts data shows Canada's construction sector continues to adapt to housing demand, particularly in the multi-unit space. Montréal and Vancouver are thriving with strong growth, while Toronto lags behind.

For our clients, these trends reinforce the importance of local expertise. Whether you're buying, selling, investing, or building, our team is here to guide you with mortgage strategies that align with Canada's evolving housing landscape.

Reference: ref: CMHC Website

Contact Mitra Knight

Please fill in all fields below