CENTUM Instant Mortgage Loans Inc.

Brokerage # 10391

Each office is independently owned and operated.

Save your time and money by choosing our professional team.

Direct

Fax

(416) 742 8001

Address

190 Bovaird Drive West, Units 50 - 51Brampton ON L7A 1A2

Unique, innovative and trusted mortgage services

We have access to a wide and varied range of Mortgage Services to suit your exact needs. We are here to help answer any questions you might have so please feel free to contact us for more information..

Renewing Your Mortgage

Buying Your First Home

Buying Your Next Home

Reverse Mortgages

Debt Consolidation

Vacation Property

New to Canada

Mortgages for Self-Employed

Commercial Mortgages

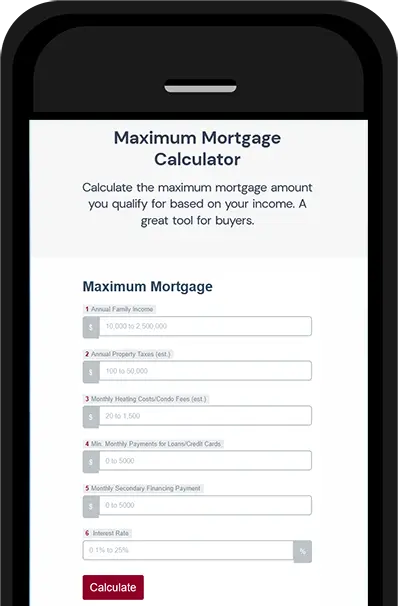

How Much Can You Afford?

Try one of our easy to use mortgage calculators to quickly and easily see what you can afford. Run payment scenarios, figure out land transfer costs, closing costs and much more!

Get Approved in 3 Easy Steps!

Find the Right Mortgage

We have access to over 50 lenders from across Canada to fit you into a mortgage solution

Tell Us Your Needs

Tell us about your financing needs so we can better understand your mortgage goals

Apply & Get Approved

Get pre-approved for your exact mortgage solution and start house shopping

Latest Blog Posts

Read More

Dec 10-2025 - Bank of Canada maintains policy rate at 2.25%

Read More

Fall 2025 Canadian Mortgage Trends & Insights Report

Read More

Bank of Canada lowers policy rate to 2.25%

Read More

Canadian Home Sales Poised for a Strong Finish in 2025

Bank of Canada Rate Hold, What It Means for Variable Rates and 2026 Renewals

Bank of Canada Rate Hold, What It Means for Variable Rates and 2026 Renewals

When the Bank of Canada announces a rate decision, it immediately grabs headlines. But for homeowners, the real question is always the same, what does this actually mean for my mortgage?

With the Bank of Canada holding its policy rate steady in December, many Canadians are wondering how this affects variable-rate mortgages today and what it signals for mortgage renewals heading into 2026.

A rate hold does not mean nothing is happening. In fact, it often provides important clues about where mortgage rates may head next, and how borrowers should think about renewals, refinancing, and overall affordability.

What a Bank of Canada rate hold really means

When the Bank of Canada holds its policy rate, it is choosing to pause rather than raise or cut borrowing costs. This decision reflects how the central bank views inflation, economic growth, and overall financial stability at that moment.

For homeowners, the key takeaway is that a rate hold is not a promise. It is a snapshot of current conditions. The Bank is essentially saying it wants more data before making its next move.

This matters because mortgage rates, especially variable rates, are closely tied to the Bank of Canada's overnight rate.

How a rate hold affects variable-rate mortgages

Variable-rate mortgages are directly influenced by the Bank of Canada's policy rate. When rates are held, most lenders keep their prime rate unchanged, which means variable mortgage payments or interest costs typically stay the same.

For homeowners already in a variable-rate mortgage, a rate hold can bring a sense of short-term stability. Monthly payments do not increase, and borrowers get breathing room after a period of higher rates.

However, it is important to understand that a rate hold does not automatically signal that cuts are imminent. It simply means the Bank is not convinced yet that inflation risks are fully behind us.

Static payment vs adjustable payment variables

Some variable-rate mortgages have static payments, where the payment stays the same but the portion going toward interest changes. Others have adjustable payments that move up or down with rate changes.

A rate hold keeps both structures stable for now, but borrowers should still review how close they are to their trigger rate, especially if rates remain elevated longer than expected.

Why this matters for 2026 mortgage renewals

Canadians renewing in 2026 are watching rate decisions closely. Many homeowners locked into ultra-low fixed rates in 2021 and 2022 are facing significantly higher renewal rates, even with recent stabilization.

A rate hold can suggest that the Bank of Canada believes inflation is cooling but not fully under control. This can influence how lenders price both fixed and variable mortgage options going forward.

For renewal borrowers, timing and preparation are becoming more important than trying to perfectly predict rates.

Renewal strategy matters more than rate guessing

Rather than focusing on whether the next move is a cut or another hold, homeowners should focus on renewal flexibility, prepayment options, and how different terms fit their budget.

A rate hold environment often leads to lenders competing more aggressively for strong borrowers, which can create opportunities for those who prepare early.

What fixed-rate borrowers should understand

Fixed mortgage rates are not directly set by the Bank of Canada. They are influenced by bond yields and broader market expectations about inflation and economic growth.

When the Bank holds rates, it can help stabilize bond markets, but fixed rates may still move up or down based on inflation data and global economic conditions.

This is why some homeowners see fixed rates change even when the Bank of Canada does not move its policy rate.

How affordability fits into the picture

Affordability remains one of the biggest challenges for Canadian homeowners and buyers. A rate hold can prevent immediate payment shocks, but it does not undo the impact of higher rates over the past few years.

For many households, the focus is shifting toward managing cash flow, extending amortizations where possible, and reviewing refinancing options that improve monthly affordability.

This is especially important for homeowners approaching renewal who may be rolling higher interest costs into their long-term budget.

What homeowners should consider right now

- Review your current mortgage type, variable or fixed, and how it responds to rate changes

- If renewing in the next 12 to 18 months, start planning early rather than waiting

- Understand your lender's prepayment and renewal options

- Run scenarios to see how different rates impact your monthly payment

- Focus on overall affordability, not just the headline rate

Why working with a mortgage professional matters more now

In a market shaped by rate holds and uncertainty, mortgage advice matters more than ever. Online headlines rarely explain how decisions affect individual households.

A mortgage professional can help you understand how a rate hold impacts your specific situation, whether that means staying variable, switching to fixed, refinancing, or adjusting your amortization.

The goal is not to predict the Bank of Canada's next move. The goal is to make sure your mortgage still works for you regardless of what happens next.

FAQs about Bank of Canada rate holds and mortgages

1) Does a Bank of Canada rate hold mean mortgage rates will go down soon

Not necessarily. A rate hold means the Bank is waiting for more economic data. Mortgage rates can still move based on inflation trends and bond markets.

2) Will my variable mortgage payment change during a rate hold

In most cases, no. When the policy rate is held, lenders usually keep their prime rate unchanged, which keeps variable payments or interest costs stable.

3) Should I switch from variable to fixed after a rate hold

It depends on your risk tolerance, budget, and timeline. A rate hold can be a good time to review options, but switching should be based on your full financial picture.

4) How early should I prepare for a 2026 mortgage renewal

Ideally 12 months in advance. Early planning gives you more flexibility and time to compare options, rather than accepting last-minute terms.

5) Does a rate hold improve mortgage affordability

A rate hold prevents further increases, which helps with stability, but it does not reverse past rate hikes. Affordability planning is still essential.

Dec 10-2025 - Bank of Canada maintains policy rate at 2.25%

The Bank of Canada today held its target for the overnight rate at 2.25%, with the Bank Rate at 2.5% and the deposit rate at 2.20%.

Major economies around the world continue to show resilience to US trade protectionism, but uncertainty is still high. In the United States, economic growth is being supported by strong consumption and a surge in AI investment. The US government shutdown caused volatility in quarterly growth and delayed the release of some key economic data. Tariffs are causing some upward pressure on US inflation. In the euro area, economic growth has been stronger than expected, with the services sector showing particular resilience. In China, soft domestic demand, including more weakness in the housing market, is weighing on growth. Global financial conditions, oil prices, and the Canadian dollar are all roughly unchanged since the Bank's October Monetary Policy Report (MPR).

Canada's economy grew by a surprisingly strong 2.6% in the third quarter, even as final domestic demand was flat. The increase in GDP largely reflected volatility in trade. The Bank expects final domestic demand will grow in the fourth quarter, but with an anticipated decline in net exports, GDP will likely be weak. Growth is forecast to pick up in 2026, although uncertainty remains high and large swings in trade may continue to cause quarterly volatility.

Canada's labour market is showing some signs of improvement. Employment has shown solid gains in the past three months and the unemployment rate declined to 6.5% in November. Nevertheless, job markets in trade-sensitive sectors remain weak and economy-wide hiring intentions continue to be subdued.

CPI inflation slowed to 2.2% in October, as gasoline prices fell and food prices rose more slowly. CPI inflation has been close to the 2% target for more than a year, while measures of core inflation remain in the range of 2½% to 3%. The Bank assesses that underlying inflation is still around 2½%. In the near term, CPI inflation is likely to be higher due to the effects of last year's GST/HST holiday on the prices of some goods and services. Looking through this choppiness, the Bank expects ongoing economic slack to roughly offset cost pressures associated with the reconfiguration of trade, keeping CPI inflation close to the 2% target.

If inflation and economic activity evolve broadly in line with the October projection, Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment. Uncertainty remains elevated. If the outlook changes, we are prepared to respond. The Bank is focused on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval.

Information note

The next scheduled date for announcing the overnight rate target is January 28, 2026. The Bank's next MPR will be released at the same time.

Fall 2025 Canadian Mortgage Trends & Insights Report

Did You Know ?

Did you know that despite encouraging signs of stabilization in the Canadian mortgage market this fall, the national household debt-to-income ratio remained at an eye-opening 181.8 % in Q2 of 2025, reversing seven straight quarters of decline? That's right, for every dollar of disposable income Canadian households had in that quarter, there was about $1.82 of debt. (Source: Canada Mortgage and Housing Corporation (CMHC) Fall 2025 Report) And while the national mortgage delinquency rate dipped slightly, one province, Ontario, saw an alarming year-over-year jump of 44 %, rising to 0.23 % in Q2 2025. These figures are prompting mortgage professionals, lenders and borrowers alike to take a closer look at the underlying trends. So the question isn't just "What's happening?" but rather "What does this mean for homeowners, borrowers, and advisors in the months ahead?"

Introduction

As our team of seasoned advisors working with clients across Canada, we've been monitoring the fall edition of CMHC's Residential Mortgage Industry Report (RMIR) very closely. The latest findings give us important signals, both cautionary and opportunistic, about borrower behaviour, lender activity, and macro-housing finance risk in the Canadian market. In this blog post, we'll walk through the key themes from the report, offer context, interpret what it means for mortgage clients, and provide actionable takeaways for homeowners, borrowers, and industry professionals alike. Our aim is to build trust, transparency and forward-looking guidance, so you can navigate the mortgage landscape with confidence and clarity.

Key Insights from the Fall 2025 Report

The full RMIR provides a rich set of data and trends. Here are some of the most noteworthy themes for this fall:

- Borrower behaviour is shifting. After a period of strong interest in variable-rate mortgages, we are seeing a rebound in fixed-rate 3 to 5 year terms. At chartered banks, fixed-rate mortgages with 3 to less than 5 year terms reached 43 % of newly extended mortgages in August 2025.

- Mortgage debt is rising again. Total residential mortgage debt in Canada reached about $2.3 trillion by August 2025, up 4.8 % from a year earlier.

- Household leverage remains elevated. The household debt-to-disposable-income ratio stood at 181.8 % in Q2 2025, after seven quarters of decline.

- Delinquency and stress are regionally uneven. National mortgage delinquency rates dipped slightly, but Ontario's delinquency rate rose 44 % year-over-year to 0.23 % in Q2 2025, with Toronto at 0.24 %.

- Lenders' market shares are shifting. The Big 6 banks increased their market share of originated mortgages to about 59 %, driven in part by consolidation such as Royal Bank of Canada's acquisition of HSBC Bank Canada.

- Originations grew. The first half of 2025 saw mortgage originations, purchases, refinances and switches, grow compared with the same period in 2024, helped by increases in insured mortgages and refinances.

Context & What It Means

Putting the data into perspective, what is behind these trends and how should borrowers and advisors think about them?

First, the rebound in fixed rate mortgages suggests that borrowers are seeking stability in uncertain economic times. With interest rate expectations becoming more volatile, the appeal of locking in a fixed payment is understandable. This has implications for mortgage planning, borrowers who locked into shorter-term fixed or variable rates earlier may now face rate renewal shock or shifting options.

Second, mortgage debt growth and elevated leverage highlight potential vulnerability. While debt levels improved for several quarters, the rebound means many households are still holding large debt burdens relative to income. That matters because when interest rates rise or economic growth slows, servicing that debt becomes more challenging.

Third, the regional variation matters. A national delinquency rate of approximately 0.22 % might look benign on the surface, but when a major province registers a 44 % increase year-over-year, the risk becomes more tangible. Advisors and borrowers must consider local market conditions, not just national averages.

Fourth, lender consolidation and market share shifts indicate competitive pressure and changing dynamics in the industry. For clients, this means fewer but larger players, which could impact product offerings, service levels, and negotiation power.

Finally, the growth in originations suggests that despite headwinds, there remains demand, both for purchase and refinance. That is a positive sign, but it also means the tailwinds may mask underlying risk if household finances weaken.

What Homeowners and Borrowers Should Do

Based on these insights, here is a suggested action plan for Canadian homeowners and borrowers:

- Review your renewal timeline and assess whether your current term and rate remain appropriate in this environment.

- Reassess your debt load and serviceability in light of possible rate increases or income changes.

- Consider longer-term fixed rates if you value payment certainty and are concerned about rate volatility.

- Stay aware of local market conditions and do not rely solely on national figures.

- Engage early with a trusted advisor to explore your options.

- Maintain a financial buffer for unexpected changes or rising costs.

Stats Section

Key indicators highlighting Canada's current mortgage environment:

- Residential mortgage debt of approximately $2.3 trillion.

- Household debt-to-disposable-income ratio of 181.8 %.

- Household debt-to-GDP ratio of 100.2 %.

- 43 % of new mortgages at chartered banks were 3 to 5 year fixed terms.

- Ontario delinquency rate increased to 0.23 %.

- Big 6 banks now hold approximately 59 % market share of new mortgage originations.

Top 10 FAQs

- Is now a good time to lock in a fixed-rate mortgage? It may be smart for payment certainty if volatility concerns you.

- Should I worry about national debt ratios? Focus on your personal debt position.

- Are regional markets safe? Not all regions perform equally.

- How does consolidation affect me? It may reduce product variety.

- What should I do before renewal? Plan early and review options.

- Are long amortizations risky? They increase long-term interest.

- Does region affect risk? Yes, significantly.

- How to protect from rate rises? Stress test your budget.

- Are variable rates risky? They carry uncertainty.

- How should advisors guide clients? Focus on transparency and risk awareness.

Final Thoughts

Our team, we believe well-informed clients make better decisions. The Fall 2025 CMHC report shows a mix of stability and caution. While the market is not in crisis, it is evolving and requires thoughtful planning.

Now is the time for homeowners to review mortgage strategies, assess risk, and prepare for upcoming renewals. With clarity, planning and professional guidance, the path forward can remain secure and confident.

Nov. 2025 - How the Bank of Canada Rate Cut Affects Your Refinancing Strategy

On October 29 2025, the Bank of Canada (BoC) reduced its target overnight rate by 25 basis points to 2.25 %. For Canadian homeowners who are thinking about refinancing their mortgage, this move matters-potentially changing the cost, timing and type of mortgage strategy you choose.

Understanding What the Rate Cut Means

When the BoC lowers its policy rate, it influences short-term borrowing costs, prime rates, and indirectly the mortgage market. But the impact is not uniform-fixed-rate and variable-rate mortgages may respond differently.

Here are the key facts:

- The BoC's overnight rate target is now **2.25%**, down from 2.50%.

- This is the second consecutive cut in recent months.

- The Bank noted that the economy is showing signs of structural adjustment, including weaker growth and trade impacts, and believes the current rate is "about the right level" if inflation and activity follow their outlook.

- Forecasts from Canadian banks suggest the rate may hold around this level (2.25%) for some time rather than falling much further.

What This Means for Refinancing Your Mortgage

If you hold a mortgage in Canada and are considering refinancing, now is a timely moment to review your strategy. Here's how the rate cut could create opportunities, or signal caution.

1. Variable-rate mortgages become more attractive

Because variable-rate mortgages are typically tied to the prime rate (which tends to follow the BoC's policy rate), a drop in the policy rate often means your variable mortgage payments may drop, or more of your payment goes toward principal.

If you currently have a variable-rate mortgage or are considering switching to one during refinancing, this cut suggests you might benefit from lower monthly payments, provided you're comfortable with the variable-rate risk (i.e., rates could go up in future). For example, one industry note highlighted that a 25 bps cut could translate into "roughly $12.50/month savings per $100,000 of mortgage debt," depending on amortization and other factors.

2. Fixed-rate mortgages: timing and expectations

If you hold or are thinking of a fixed-rate mortgage, the impact is more muted. Fixed rates are driven by bond yields, lender margins and expectations for future rate changes. A policy rate cut doesn't immediately guarantee a lower fixed mortgage rate.

According to the BoC's own analytical note, about 60 % of Canadian mortgage holders renewing in 2025–2026 may still face increased payments compared with December 2024, even in a lower rate environment-particularly those with five-year fixed terms.

For refinancing a fixed-rate mortgage, you should compare the current fixed-rate product with your renewal or payout penalties, amortization remaining, and overall cost. If fixed rates remain high relative to where you could lock in, there may still be value-but the "cheap refinance" window may not be as wide as with variables.

3. Shorter-term vs longer-term amortization

When refinancing, you also consider amortization length. Lower interest rates, or the expectation of stable/lower rates-can allow you to shorten your amortization without significantly raising payments, or keep payments similar while reducing total interest cost.

For example: if refinancing and moving some of the equity (or cash-out) you could take advantage of a lower rate environment to set a schedule that better aligns with your long-term goals, such as eliminating the mortgage sooner and freeing up more monthly cash flow for other objectives (like your health and fitness goals, investment or retirement planning).

Three Scenarios for Homeowners

Let's walk through practical scenarios you or your clients might face, and how the rate cut changes the decision-tree.

Scenario A: You have a variable-rate mortgage and you're approaching renewal

If your mortgage is variable and you're about to renew (or switch lender) as part of refinancing, the rate cut is good news. Lower policy rate → likely lower prime → more favourable variable payments.

Action plan: review your current payment vs projected payment; ask your broker what current lender prime-based variable rates are; consider whether you expect rates to go up in the medium term (and if you're comfortable staying variable). If you expect rates to stay low for a prolonged period, staying variable or refinancing into a variable product might make sense.

Scenario B: You have a fixed-rate mortgage with a few years left and are thinking of breaking it or refinancing into another fixed term

If you hold a fixed-rate mortgage, the rate cut matters less immediately, but it still influences your expectations for future fixed rates. If lenders anticipate no further big cuts, fixed rates might not fall significantly, so waiting may not bring much benefit.

Action plan: evaluate the payout penalty; compare current available fixed terms; check how much you'd save by refinancing vs staying; assess your risk tolerance. If you have 2-3 years left, sometimes staying might be best. If you have 8-12 years left amortization or large balance, refinancing could still help lock in a strong rate.

Scenario C: You're looking to refinance and take cash-out (e.g., home equity lines, consolidations) and you're flexible

In a lower rate environment, refinancing with cash-out becomes more attractive because the interest cost is cheaper-especially if you can keep amortization manageable. Given the BoC has cut to 2.25% and signalled that it may hold there, you may have a "window" for locking favourable terms.

Action plan: assess how much equity you have, your amortization remaining, and the purpose of the cash-out. Make sure you're not extending your amortization unwisely (especially if your goal is debt reduction). Always compare rates, plus any fees or closing costs, against the benefit of doing the refinance now.

What to Watch and What Could Go Wrong

Refinancing isn't always a straightforward "yes" when rates drop. Here are some risks and factors to consider.

- Payout penalties or prepaid interest: Breaking a mortgage early often incurs costs; the rate drop may not offset that unless the savings are substantial.

- Rate floor or fixed-term lag: Just because the BoC cut the overnight rate doesn't guarantee fixed-term mortgage rates will drop equivalently or immediately.

- Shorter amortization means higher payments: If you decide to shorten amortization during refinancing, your monthly payment may rise even if the rate falls.

- Variable risk remains: Choosing a variable rate means you're exposed to future rate hikes, if the economy surprises on inflation or growth, the risk may increase.

- Market expectations: Some forecasts suggest the 2.25% policy rate may hold for some time, meaning large further cuts may not be forthcoming.

Refinancing Checklist for Canadian Homeowners

Here is a practical checklist to run through when considering refinancing in light of this recent rate cut:

- Review your current mortgage term, rate, amortization, payment and balance.

- Check how many years remain on your amortization and how many renewals you anticipate.

- Calculate your payout penalty (for fixed term) or any other costs involved.

- Check the current variable and fixed mortgage rate offers in your region/lender network.

- Estimate your new monthly payment (or compare payment change) under the refinanced amount/amortization.

- Decide whether your goal is lower monthly payment, shorter amortization, cash-out, or a combination.

- Consider your risk tolerance: are you comfortable staying variable, or prefer locking fixed now?

- Consult a trusted mortgage broker (licensed in your province) who can shop options and provide up-to-date terms.

Top 5 FAQs Canadian Homeowners Ask About This Rate Cut

Here are the most common questions we're seeing, and the answers.

- Q 1: Will my mortgage rate automatically go down because of the BoC cut?

If you have a variable-rate mortgage with payments that adjust, your rate may decrease-but fixed-rate mortgages don't change automatically. You still need to check with your lender and consider refinancing or renewal. - Q 2: Is now the best time to refinance?

It could be a strong time, especially if you're variable or your fixed rate is relatively high. However, you need to factor in your payout costs, time remaining, new amortization and your overall financial goals. - Q 3: Should I switch from fixed to variable now?

That depends on your risk tolerance. The rate cut makes variable mortgages more appealing, but they carry the risk of future rate increases. If you prefer stability, staying fixed might still make sense. - Q 4: Are further rate cuts likely?

The BoC signalled that the current policy rate is "about the right level" if the outlook holds, which may suggest fewer big cuts ahead. - Q 5: How much could I save by refinancing?

Savings depend on your balance, amortization, new rate and costs. As one benchmark, tighter policy-rates could reduce variable mortgage payments modestly (e.g., the "$12.50 per $100,000" figure noted in industry commentary) but you must calculate based on your specific numbers.

Conclusion: What Should You Do Now?

The October 2025 rate cut by the Bank of Canada to 2.25% is a meaningful signal for Canadian homeowners: it suggests that borrowing costs may be more favourable than earlier in the year, particularly for variable-rate mortgages, and it provides an opening to reassess your refinancing strategy.

If you're approaching renewal, have a variable mortgage, or are considering cash-out or a shorter amortization, this is a timely moment to talk to your mortgage broker and review your position. On the other hand, if you're locked into a fixed rate with only a short term remaining, the benefits may be less dramatic, but still worth examining.

In short: use this rate cut as a trigger to run the numbers, compare your options, and align your mortgage strategy with your financial goals-whether that's reducing your monthly payment, paying off your home faster, or freeing up cash flow for other priorities.

Need help? Our team specializes in Canadian mortgages and can review your renewal or refinance options tailored to your province, property type and long-term goals. Reach out today.

Bank of Canada lowers policy rate to 2.25%

The Bank of Canada today reduced its target for the overnight rate by 25 basis points to 2.25%, with the Bank Rate at 2.5% and the deposit rate at 2.20%.

With the effects of US trade actions on economic growth and inflation somewhat clearer, the Bank has returned to its usual practice of providing a projection for the global and Canadian economies in this Monetary Policy Report (MPR). Because US trade policy remains unpredictable and uncertainty is still higher than normal, this projection is subject to a wider-than-usual range of risks.

While the global economy has been resilient to the historic rise in US tariffs, the impact is becoming more evident. Trade relationships are being reconfigured and ongoing trade tensions are dampening investment in many countries. In the MPR projection, the global economy slows from about 3¼% in 2025 to about 3% in 2026 and 2027.

In the United States, economic activity has been strong, supported by the boom in AI investment. At the same time, employment growth has slowed and tariffs have started to push up consumer prices. Growth in the euro area is decelerating due to weaker exports and slowing domestic demand. In China, lower exports to the United States have been offset by higher exports to other countries, but business investment has weakened. Global financial conditions have eased further since July and oil prices have been fairly stable. The Canadian dollar has depreciated slightly against the US dollar.

Canada's economy contracted by 1.6% in the second quarter, reflecting a drop in exports and weak business investment amid heightened uncertainty. Meanwhile, household spending grew at a healthy pace. US trade actions and related uncertainty are having severe effects on targeted sectors including autos, steel, aluminum, and lumber. As a result, GDP growth is expected to be weak in the second half of the year. Growth will get some support from rising consumer and government spending and residential investment, and then pick up gradually as exports and business investment begin to recover.

Canada's labour market remains soft. Employment gains in September followed two months of sizeable losses. Job losses continue to build in trade-sensitive sectors and hiring has been weak across the economy. The unemployment rate remained at 7.1% in September and wage growth has slowed. Slower population growth means fewer new jobs are needed to keep the employment rate steady.

The Bank projects GDP will grow by 1.2% in 2025, 1.1% in 2026 and 1.6% in 2027. On a quarterly basis, growth strengthens in 2026 after a weak second half of this year. Excess capacity in the economy is expected to persist and be taken up gradually.

CPI inflation was 2.4% in September, slightly higher than the Bank had anticipated. Inflation excluding taxes was 2.9%. The Bank's preferred measures of core inflation have been sticky around 3%. Expanding the range of indicators to include alternative measures of core inflation and the distribution of price changes among CPI components suggests underlying inflation remains around 2½%. The Bank expects inflationary pressures to ease in the months ahead and CPI inflation to remain near 2% over the projection horizon.

With ongoing weakness in the economy and inflation expected to remain close to the 2% target, Governing Council decided to cut the policy rate by 25 basis points. If inflation and economic activity evolve broadly in line with the October projection, Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment. If the outlook changes, we are prepared to respond. Governing Council will be assessing incoming data carefully relative to the Bank's forecast.

The Canadian economy faces a difficult transition. The structural damage caused by the trade conflict reduces the capacity of the economy and adds costs. This limits the role that monetary policy can play to boost demand while maintaining low inflation. The Bank is focused on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval.

Information note

The next scheduled date for announcing the overnight rate target is December 10, 2025. The Bank's next MPR will be released on January 28, 2026.

Canadian Home Sales Poised for a Strong Finish in 2025

The Canadian housing market is showing signs of renewed strength as we approach the end of 2025. According to the latest report from the Canadian Real Estate Association (CREA), home sales across the country are on track for a strong finish to the year, buoyed by lower borrowing costs, improving consumer confidence, and a more balanced market.

A Shift Toward Market Stability

After several years of adjustment, the national housing market appears to be finding its footing once again. CREA's data shows that both home sales and average prices have been steadily improving in most major markets. This rebound comes as many buyers and sellers regain confidence, encouraged by recent interest rate reductions and a more predictable lending environment.

While the pace of growth varies from region to region, markets that experienced the sharpest slowdowns during the high-rate period-such as Ontario and British Columbia-are now seeing a modest recovery. Meanwhile, more affordable provinces like Alberta, Saskatchewan, and parts of Atlantic Canada continue to attract strong demand from both first-time buyers and relocating families.

Interest Rate Cuts Helping Buyers Re-Enter the Market

One of the key drivers behind the recent uptick in activity is the Bank of Canada's move to gradually reduce interest rates in 2025. These rate cuts have helped improve affordability for many households that had been priced out of the market in previous years. Lower rates mean lower monthly mortgage payments, allowing buyers to stretch their budgets a little further and renew their homeownership goals.

For existing homeowners, refinancing or renewing at a lower rate has also provided some much-needed financial relief, especially after several years of rising costs. Mortgage professionals across the country are reporting an increase in consultations as clients explore opportunities to secure better terms or plan their next purchase.

National Home Prices Showing Modest Gains

CREA's latest figures indicate that the national average home price has been edging upward in recent months. While prices remain below their 2022 peaks, the stabilization is a positive sign for both homeowners and the broader economy. This trend suggests that Canada's housing market is entering a healthier phase, where prices are more closely aligned with fundamentals like income growth and supply levels.

Balanced conditions in many cities are also giving buyers more time and choice. This shift away from the intense bidding wars of past years has created opportunities for well-qualified buyers to negotiate favourable terms and find homes that truly meet their needs.

Supply Levels Still a Key Factor

Despite the encouraging rebound in sales, Canada continues to face a structural shortage of housing supply. CREA notes that new listings have increased slightly, but the number of available homes remains below long-term averages in many markets. Population growth and continued immigration are putting added pressure on supply, highlighting the need for ongoing construction and development across the country.

Federal and provincial housing initiatives are expected to play a vital role in addressing this imbalance. As new housing projects move forward, more inventory could help keep price growth sustainable in 2026 and beyond.

What This Means for Buyers and Homeowners

For Canadians thinking about buying, selling, or refinancing, the current market presents a window of opportunity. Lower interest rates, stable prices, and growing confidence are combining to create favourable conditions for those ready to make a move. Whether you're entering the market for the first time, upgrading to a larger home, or considering an investment property, understanding your financing options is more important than ever.

Working with an experienced mortgage broker can help you navigate the changing landscape, compare lenders, and find a solution that fits your budget and long-term goals. A broker can also assist with pre-approvals, rate holds, and refinancing strategies designed to take advantage of today's improving conditions.

Looking Ahead to 2026

As CREA forecasts continued stability into early 2026, most experts agree that Canada's housing market is transitioning into a more balanced and sustainable environment. While challenges remain-especially around supply and affordability-the overall outlook is more optimistic than it has been in several years.

If you've been waiting for the right moment to act, now may be an ideal time to review your mortgage options and prepare for what's ahead. Reach out to a licensed mortgage professional in your area to discuss how today's market trends could work in your favour.

Sources

Data and insights referenced in this article are based on the October 2025 housing market update from the Canadian Real Estate Association (CREA).

Contact CENTUM Instant Mortgage Loans Inc.

Please fill in all fields below